When it comes to potential growth areas for the insurance industry, Cyber Liability, a relatively new coverage area, has been getting much of the recent attention.

But Environmental insurance—which is now many decades old—may also represent a very real chance for carriers and producers to significantly increase their premium volumes—if they can succeed in convincing a broad swath of commercial buyers that coverage is necessary, even for organizations that don't consider themselves polluters.

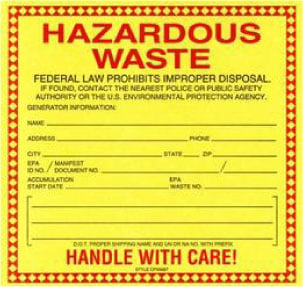

For some select classes of business, the financial backstop of Pollution insurance has long been a mandatory buy. Under the 1976 Resource Conservation and Recovery Act, owners of landfills; underground storage tanks; and hazardous waste treatment, storage and disposal facilities must provide financial-responsibility assurances to cover remediation and third-party damages stemming from a pollution incident.

For some select classes of business, the financial backstop of Pollution insurance has long been a mandatory buy. Under the 1976 Resource Conservation and Recovery Act, owners of landfills; underground storage tanks; and hazardous waste treatment, storage and disposal facilities must provide financial-responsibility assurances to cover remediation and third-party damages stemming from a pollution incident.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.