The Travelers Cos. says fourth-quarter net income was sliced in half due to losses associated with Superstorm Sandy.

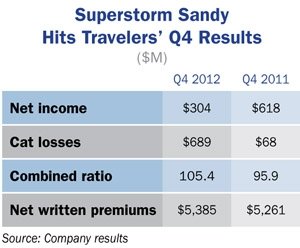

Travelers says net income for the last quarter of 2012 was $304 million compared to $618 million for the same period the prior year. Fourth-quarter operating income fell to $278 million from $209 million.

Catastrophe losses for the fourth quarter were $689 million, after tax. In 2011 during the same three months, catastrophe losses were $68 million.

The New York-based insurer says Sandy, which struck the Northeast shortly before Halloween,

caused $669 million in catastrophe losses, after tax. The total is slightly above an after-tax estimate of $650 million in losses from Sandy the insurer released early in December.

The fourth-quarter combined ratio deteriorated to 105.4 from 95.9 during 2011's fourth quarter.

In a statement, CEO Jay Fishman focused on underlying results for the full year.

Net income for all of 2012 jumped 73 percent to about $2.47 billion from $1.43 billion in 2011. The full-year combined ratio improved to 97.1 in 2012 compared to 105.1 the year prior.

Operating income in 2012 increased $1 billion to $2.4 billion compared to 2011, when after-tax catastrophe losses were $1.7 billion—about $500 million more than 2012.

Fishman says “higher underlying underwriting margins contributed significantly” to the full-year improvement, “attributable to improved non-catastrophe, weather-related losses and the significant pricing gains we have been realizing.”

Fishman says the company is “encouraged” by pricing trends in all business segments.

“Given the continued low interest rate environment and uncertain weather patterns, we will continue to seek improved pricing,” Fishman continues in the statement.

Earned rate increases exceeded loss-cost trends in the Business Insurance segment, says Brian MacLean, president and COO. Workers' Compensation and Commercial Auto led rate gains of between 6 percent and 10 percent during 2012's last quarter, he adds.

MacLean says rate hikes in the Auto business “are now exceeding our current view of loss trends” although the company isn't yet satisfied with overall results of the line. And while Travelers is “very pleased” with is results in Homeowners', it remains “concerned about uncertain we4ather patterns and we will continue to seek improved pricing, terms and conditions,” MacLean says.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.