For property and casualty insurers, 2012 was looking like it would be a banner year, until Superstorm Sandy struck, say commentators.

The remarks come with the release of the P&C insurance industry's nine-month report on profitability from the Insurance Services Office (ISO), a Verisk Analytics company, the Property Casualty Insurers Association of America, and the Insurance Information Institute.

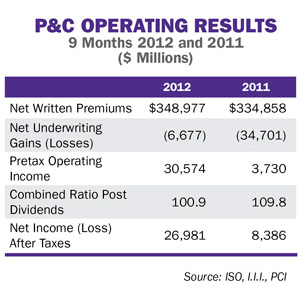

For the first nine months of 2012, net income after taxes grew to $27 billion, compared to $8.4 billion in 2011.

For the first nine months of 2012, net income after taxes grew to $27 billion, compared to $8.4 billion in 2011.

Net losses on underwriting dropped to $6.7 billion over the first nine months of this year, compared to $34.7 billion for 2011.

A key measure of results, the combined ratio, improved 8.9 points to 100.9. The improved underwriting results came from the drop in catastrophes as measured in net losses and loss adjustment expenses (LLAE).

The LLAE, ISO estimates, for the first nine months of 2012 totaled $16.7 billion, down from more than $35 billion for the same period in 2011.

However, net investment gains fell more than $4 billion to $38 billion.

Earnings were also affected by an increase in federal and foreign income taxes that rose close to $5.7 billion, to $6.6 billion.

Policyholder's surplus (the measure of insurers' net worth measured by Statutory Accounting Principals) grew $29.7 billion to $583.5 billion.

Commentators from ISO, PCI and I.I.I. note that the positive results for insurers this year will help them absorb losses from Sandy. “Results like those for nine-months 2012 provide insurers with the financial wherewithal necessary to absorb shock losses such as those inflicted by Hurricane Sandy last October and continue to fulfill their commitments to policyholders,” says Robert Gordon, PCI's senior vice president for policy development and research, in a statement. He adds that the “record-high” policyholder's surplus translates into insurers having “more than enough capital to cover losses from Hurricane Sandy.”

Michael R. Murray, ISO's assistant vice president for financial analysis, says it will be a while before the full cost of Sandy is known, but the storm “will certainly take a toll on insurers' results for fourth quarter and full-year 2012.”

Robert Hartwig, president of I.I.I., says that while current insured-loss estimates make Sandy quite possibly the fourth largest natural catastrophe loss for insurers, “the bottom line is that the property and casualty insurance industry ended the third quarter of 2012 in extremely strong financial condition, fully prepared for the storm's enormous cost.”

He adds, “Fundamentally, the P&C insurance industry remains quite strong financially, with capital adequacy ratios remaining high relative to long-term historical averages.”

The report notes that third-quarter net income for 2012 stood at $10.4 billion, an increase from more than $3.4 billion from the prior year. The combined ratio for the period improved 10 points to 98.5.

One line of business that continues to suffer is mortgage and guaranty insurers.

Those insurers shaved 60.6 points off their combined ratio from last year, but the figure was still a high 165.4.

However, net premiums written dropped close to 8 percent to $3.6 billion and net earned premiums fell 5.5 percent to $4.4 billion.

Excluding mortgage and financial guaranty insurers, the industry's combined ratio would have stood at 100 instead of 100.8, and net written premiums would have risen 4.4 percent instead of 4.2 percent.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.