Fitch Ratings says that, barring a rash of catastrophic losses or an increase in inflation, the property and casualty insurance industry should remain stable into 2013.

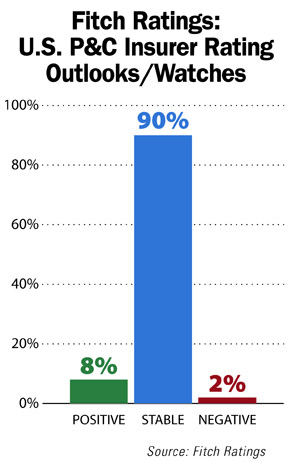

In a report, “2013 Outlook: Property/Casualty Insurance,” the ratings agency paints a positive picture for the industry overall. The outlook is for both U.S. commercial and personal lines.

After years of a prolonged soft market and dealing with the economic downturn, Fitch says, “The market capital position remains strong” and the carriers the firm rates “have sufficient capital to meet significant future adversity.”

After years of a prolonged soft market and dealing with the economic downturn, Fitch says, “The market capital position remains strong” and the carriers the firm rates “have sufficient capital to meet significant future adversity.”

Among the positives, surplus levels “remain at historic high levels” and capital adequacy remains “very strong.” This is helped by “investment emphasis on high-quality and liquid bonds, adequate loss reserves….”

Fitch notes that insurance rates have been on the increase in both commercial and personal lines and the “trend is likely to continue at least through late 2013.”

Fitch believes “this is a hardening market, in contrast to a hard market where rates are at a level consistent with returns at or above required rates of return on capital.”

A turn to a truly hard market is “questionable” in the near future, Fitch says, as pricing is in “response to losses that will eventually be overwhelmed by competitive forces.”

Competition, the rating service says, “will return the market to flat or declining rates before any hard market transpires.”

Fitch says its outlook could change if catastrophes reduce surplus by more than 20 percent. The rating outlook could also turn negative if there is deterioration in accident-year underwriting losses that reduces capital.

An increase in inflation could raise loss costs, promoting higher loss ratios and reserve deficiencies, says Fitch.

Assuming “an average year for catastrophe-related losses,” the industry could experience “a very modest underwriting profit in 2013,” says Fitch.

However, looking further ahead, the combination of the “inherent volatility” of the insurance business and the competitive nature of carriers could make it difficult for insurers to boost returns in 2014 and beyond.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.