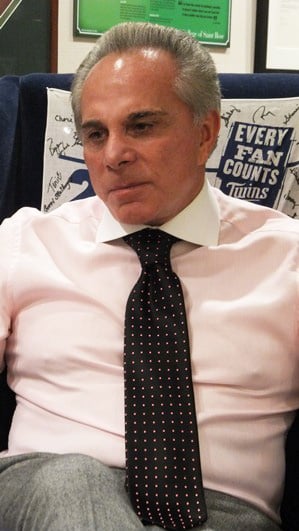

It's not retirement, says Joe Plumeri, the chief executive officer of Willis Group Holdings, but just another phase in his long career.

After 12 years of steering the insurance brokerage firm through turbulent waters Plumeri will leave his post on Jan. 7. He brought the firm through private ownership by the private equity firm Kohlberg Kravis Roberts to public ownership in 2001; through the attack on the World Trade Center; New York Attorney General Eliot Spitzer's prosecution over alleged kickbacks and steering of business in return for contingent commissions and the $2.1 billion acquisition of Hilb Rogal & Hobbs in 2008 as the great recession hit.

He will serve as non-executive chairman through July 2013, when his contract expires.

Recently, PC360 sat down with Plumeri to discuss his reasons for leaving and share his views about Willis, the industry, climate change, contingent commissions and criticism of Eliot Spitzer.

Q: Why are you retiring?

Plumeri: I'm not retiring. I'm leaving Willis. There's a difference between the two. I actually think that there is a point in time where you've done your thing and it comes time to leave room for the next generation, the next group, to come in and take it to the next level.

In the past 12 years, we took a company that didn't make money and was not a force in this industry and brought it to its position today.

I think the worst thing I ever saw was Willie Mays try to steal second base when he was 45-years old. No one remembers Joe DiMaggio as a broken down ballplayer. Sometimes you just stay too long. Sometimes you outlive your stay.

It's not that you're any less enthusiastic about the company. You just know that it is time and you know when the time is.

Q: Do you know what the next phase of your career will be?

P: No, I don't. I know it will be something that will involve people. I would like to do something that engages me with a lot of people and gives me the opportunity to make a difference in people's lives. I like people businesses and businesses that are driven by people.

I've always been in people businesses and run people businesses, and people have always asked me why do you like people businesses?

I said, you make a machine, and it is built to do just so much and no more, until they make another machine. Humans don't come close to being able to reach their potential. With the right environment, the right motivation, and the right set of circumstances, everyone can do more. So it is exciting to see people motivated and enthused and doing things that they never dreamed they could do. That's what I think leadership is about.

Q: A lot has happen in 12 years. Has this job turned out to be what you expected it to be?

P: I don't know what I expected it to be, so that's a tough question. I don't think anyone goes into a job with an expectation of what it will be. I didn't write down what I expected.

It's a global company; I expected to trot the globe; I expected to learn more about the world than I knew before, that I expected. I expected to be on the airplane a lot; that was done.

But in terms of expectation of the company, I don't think you think in terms of expectation as much as you think of broad visions where you paint these murals in your head and think I'm going to take this company and make it something that the world knows is there and makes an impact.

That was the vision and expectation.

That was the vision and expectation.

Q: Did you expect to stay here for 12 years?

P: No. I don't think anyone expects to be a CEO for that amount of time. You go in, do what you have to do, and then see where fate takes you.

I don't think there are such things as expectation levels like that. Twelve years is a long time in CEO life, especially with the pressure to do well consistently over time. Then throw in the catastrophes that have taken place, the regulations that have taken place, the economic breakdown in the world over the past four years.

When I look at the twelve years after enduring all that, and see the shape the company is in, I feel good about what I am leaving. That is what you want to say, isn't it.

Q: What do you feel are the high points and low points in your career?

P: I think the way we conducted ourselves during the Spitzer investigations was the high point. The integrity that we showed and the integrity that we showed and the brand that is associated with that integrity makes me feel better than any shareholder return or any other metric.

The first thing that people say when you say Willis is integrity and that has to be the high point.

The low point, professionally— it wasn't a point as much as a stage—when we brought HRH.

The financial crisis began and the degree of difficulty in acquiring a company under such financial duress—the markets being soft and the economy being bad, credit markets closed and still getting the deal done with financing at high interest rates and all the issues that came along with that—that was a low point.

We grew dramatically during eight years before that happened, and the low point began when we brought HRH on. It was not a low point to buy HRH. I think the decision was the right decision. I think the timing could have been better. You don't have jurisdiction over timing.

When you look back three years from now, I think history will reflect that it was a good decision. And after having endured everything that we endured, we're in a great place in North America.

Q: You took a very active role criticizing contingent commissions. Are you disappointed with the way the issue turned out?

P: I was criticized for my position, and even received a letter from an agent's association. But I never had a problem with contingents, I just felt that clients need to know who you represent. Do you represent insurance companies or do you represent them. My issue was accepting them from anyone but your client and simply telling people who you represent.

I'm disappointed with the way it was handled by Spitzer. It was a perfectly legitimate topic to put on the table. And I think the way he went about it was irresponsible.

I'm disappointed with the way it was handled by Spitzer. It was a perfectly legitimate topic to put on the table. And I think the way he went about it was irresponsible.

He went after Marsh, irresponsibly. It has to be irresponsible because nobody got convicted and he put a lot of nice people through hell.

[He went after] Aon, [Arthur J.] Gallagher, and us and then stopped. It was disingenuous on his part. I was genuine on the issue, because I thought it was a conflict. I said to him, if you are that genuine about contingents, why don't you simply ban contingents for everyone who does business in the state of New York—period?

But it just seemed to be bad for three or four of us and not for everybody, and I just thought it was not handled properly.

It's almost as if he said, 'I got the attention I wanted now it's time to move on.' And I think that's terrible.

If he was that passionate about it, he would have gotten them banded for everybody in the state of New York. That's what disappoints me the most.

In the meantime, everyone else can take them from insurance companies that paid them. Then, after four years, the [bans] were sunset and they can go back and it's okay. It's just a total farce.

Q: Do you think the way contingent commissions are paid will change?

P: This not a situation that is going to change. And my opinion is not going to change.

I'm disappointed in clients not demanding change and that they don't appreciate who pays brokers, and I'm not sure if we are as transparent as we should be. And I'm disappointed that the process started out in a way that challenged contingents and it turned into a circus.

Q: The industry just went through this disaster with Superstorm Sandy. Do you think that the industry is responding the way it should? Are there lessons to take away from this?

P: I think there is too much discussion about FEMA and not enough about the insurance industry. If you look at Katrina, it had insured losses of about $70 billion. The insurance industry paid about $47 billion of it and FEMA and state governments paid the rest. Everybody talks about FEMA as if it is an insurance agency. FEMA puts up tents. They give out food. They don't put up houses. The insurance industry puts up houses and we don't get credit for the houses we are putting up. There's too much discussion about flood, wind and storm surge.

Willis] had 1,200 personal lines claims and 700 commercial lines claims and all our people were working the next day after Sandy from home or someplace, trying to take care of our clients. In our industry, you got to be open when someone else has a problem. I think we did that magnificently. And if you spoke to another insurance company or broker, I think they would have told you the same thing.

I think there is an education problem with the public about what the government does and what the insurance industry does. I think we comported ourselves quite well. I think at the end of the day we will have insured losses of $30 billion when everything is said and done. A lot of business interruption and contamination clean-up.

The industry has a great opportunity now to help government try to figure out what the effects are of these storms and how we're all going to pay for it.

Q: Do you feel that this is part of climate change?

Q: Do you feel that this is part of climate change?

P: There's something going on. I'm not going to tell you I understand why. I can only tell you that spring use to be spring; summer use to be summer; fall use to be fall, and winter use to be winter, and I can't tell the difference anymore. I don't know if it is caused by carbon. All I know is that the climate is different and these 1 in 100 year and 200 year events are not so rare anymore.

The so-called black swans are no longer black. They are at least arguably grey.

Last year there was over $300 billion in economic loss, primarily from natural disasters, not man made. There was $116 billion in insured losses in one year.

How does that translate? If I'm a CEO or in the government, I have to make sure that my electrical grids, my power and energy sources are all backed up. That's why the issue of LIPA and this kind of stuff is a big issue, because the infrastructure of counties and government was made for a different time and era. It's like the streets in New York City. They were made for 1923 or 1930, not 2012.

Now you have to re-think the world and re-think how you build buildings; re-think where you put buildings; re-think your supply chain if you're a business; re-think where your plant is; where your office is, and re-think where you are, and re-think all of this stuff if you think the world is different. And if you don't think the world is different, then I've got a bridge to sell you.

Q: What do you think about the future of the insurance industry?

P: I think the future of the insurance industry is wonderful. I think the more risky the world becomes, the more important insurance becomes. I think if we change as the world is changing, so we become less insurance brokers and more insurance advisors, advise them about how people can sustain themselves, their family, their businesses, rather than insure their businesses, then what more vital part can you play than that in a society.

Secondly, if the population explosion around the world is what people say it will be, that by 2030 you'll have six billion people in the world, and 60 percent of those people will live in cities, then by definition you're either going to have a middle class with jobs or total chaos.

If you have a middle class with jobs, then that means those businesses are going to have to be insured and sustainable and resilient, which means insurance plays a big part in making sure all of that happens.

So as the world becomes more risky, more complex, more urbanized, more populated and different because of the climate and complexity of the world, then insurance has not seen its best days. The golden era of insurance has not occurred yet.

We have 22 offices in China. Even though we do a lot of business in China, relatively speaking, it is nothing compared to the size of China because they haven't figured out the importance of insurance yet. That is yet to come.

Look at the continent of Africa and the explosion that is going to take place in Africa. You haven't seen big swaths of geography yet urbanized, commercialized, capitalized and therefore insured because of all of that. That is why I say we haven't really seen what insurance can really do and the effects of what it can represent.

Q: How do you feel about the development of a catastrophe fund?

P: I think there has to be a private and a public partnership. If I were, hypothetically, the mayor of a city or the governor of a state, I would actually put together a commission that would analyze (and I think the president should do this) how in the future, if Sandy's are going to continue to occur, how are you going to fund this stuff.

You have a national flood insurance program, which by the way has been funded by the United States government and is in debt. FEMA, which has been funded by the United States government, and is also in debt. And a disaster relief fund that is also in debt. So they are all funded and in debt.

So if we keep having storms like this and states keep asking the United States government to help them, where is that money supposed to come from?

So if we keep having storms like this and states keep asking the United States government to help them, where is that money supposed to come from?

It just seems to me that if you got people in the room from government, the insurance industry, the banking industry, to see if there are ways to self-fund this stuff by some ability to be able to put monies away on an insured basis, with some sort of a yield, like one big cat bond, we can prepare ourselves for the future.

How you actually do that, and the implementation of that, is up to the smart people to figure out.

I always found it curious that commissions are always put together to investigate why something happened, rather than a group of people to sit down and determine what you will if something happens in the future.

Q: Any parting thoughts about the insurance industry?

The pride of people being in this industry is a big deal with me. I dislike the idea that people think of our industry as something bad when in fact history shows that what we do is good. If it wasn't for us repairing cities or repairing communities they wouldn't get rebuilt. I don't think we blow our own horn enough. I don't think we publicize that enough. And I don't think we show enough pride about what we do in that regard.

We were the only industry standing during the financial crisis. Banks were not lending. We were still underwriting and paying claims. But I never saw anyone on television or on an editorial page write about that, ever.

I think someone should do a documentary or some sort of reality show on these claims adjusters, hundreds and thousands of them, going from home, to home, to home, trying to figure out what the damage is and how these people are going to get paid. That is a stout task and is the sort of thing people should take pride in.

When you do work, no matter what it may be, you like to think that what you do matters. And I think the people in the insurance industry have a great deal to feel proud about because I think what we do matters and makes a difference.

If I have made some sort of an impact, an imprint on people, and made them think—yeah, the guy's right, we do do great things in this industry—then I would look back on my time in this industry and say if that was all that I accomplished then that was a lot.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.