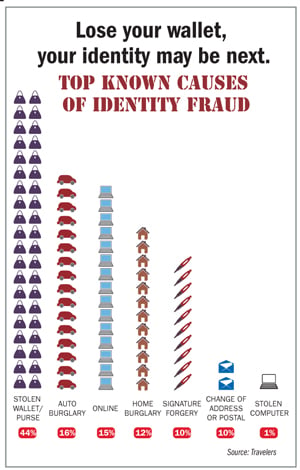

Much attention is paid to the theft of personal information over the Internet, but the number-one cause for identity theft turns out to be old-fashioned loss of personal effects, according to Travelers.

Much attention is paid to the theft of personal information over the Internet, but the number-one cause for identity theft turns out to be old-fashioned loss of personal effects, according to Travelers.

A study released by the insurer says that in this era of digital information, 73 percent of cases of identity fraud result from burglary, stolen wallets and pilfered identifications. The study is based on Travelers claim data.

Travelers says "stolen or misplaced items, such as wallets and pocketbooks, accounted for the most common known causes for identity fraud." In second place was a stolen or compromised license, Social Security card or other form of personal identification. Burglaries ranked third, followed by cyber breaches, including Internet scams and old-fashioned forgeries.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.