The airline-insurance market continues a soft-market dip, supported by healthy market capacity and a low level of claims, according to insurance broker Aon.

In its fourth-quarter market update, Aon says lead hull and liability premium figures have continued to fall through 2012, with the average airline-insurance program enjoying rate reductions of around 10 percent in November.

The decrease comes despite a 5 percent increase in average fleet values and 4 percent increase in passenger numbers.

The decrease comes despite a 5 percent increase in average fleet values and 4 percent increase in passenger numbers.

“Healthy market capacity is driving competition between underwriters,” Aon says in its market update. “Lead insurers are clearly performing for their clients as, to a great extent, few accounts are making changes.”

Aon says that only 32 of the airline-insurance programs placed in 2012 endured increases in their lead-hull liability, continuing an annual downward trend that has been in place since 2010.

Through November renewals, premium rates are down 9 percent for the year, compared to being down 3 percent for all of last year.

At the beginning of this year, it appeared the airline-insurance industry was poised for a hard-market rise, recording a 29 percent increase in rates in the first quarter. However, the remainder of the year has seen a steady decrease.

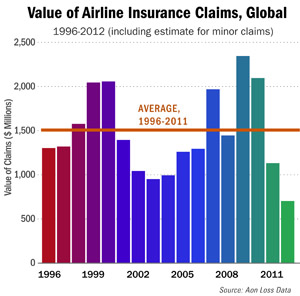

As far as loss trend, the current year, excluding minor losses, stands at $158 million in losses, compared to $486 million for the same time last year.

Including minor losses, overall total is $708 million in losses compared to just over $1.035 billion last year.

“Including an estimate for minor loss, claims for 2012 so far are 50 percent lower than the 1995-2011 average and 58 percent lower than the five year average,” says Aon.

The broker credits the low loss trends to a combination of improvements in “training and technology.”

Aon did cast doubt on the continuation of the soft-market trend, saying that the last stretch of declining rates came after sharp increases after 9/11 and “it seems unlikely that the current soft-market conditions will continue.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.