Outgoing Willis Group CEO Joe Plumeri says matters that have haunted the broker's past earnings are “out the door,” and the company is “free of costly, distracting issues.”

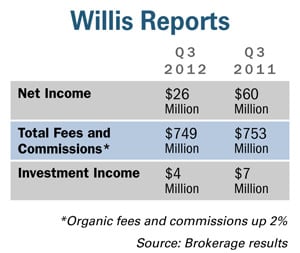

That said, Plumeri describes Willis' third-quarter results in as “disappointing.” Net income for the quarter was $26 million compared to $60 million a year ago during the same time, and third-quarter organic growth in commissions and fees of 2 percent was a bit below leadership's aims.

But during his last conference call with analysts, Plumeri said, “Nothing dulls [Willis'] general enthusiasm” for growth opportunities going forward.

But during his last conference call with analysts, Plumeri said, “Nothing dulls [Willis'] general enthusiasm” for growth opportunities going forward.

The third quarter—labeled a “watershed” one by Plumeri—was the last in which Willis would need to refer to the impacts of past issues such as previously-disclosed fraud and badly-timed acquisitions, he says.

Plumeri explains that one-off benefits recorded a year ago during the third quarter makes a comparison to this year's third quarter uneven, but, he adds, “We're leaving a clean slate behind” for incoming CEO Dominic Casserley.

There is good reason to remain optimistic, Plumeri asserts. Organic growth in North America was flat. He admits this is typically “not usually something to be pleased about,” and he is “not jumping for joy,” but it does mark an improvement.

“We consider this an achievement,” he says.

Rate increases in North America are contained to certain lines in specific geographic regions, and they remain relatively modest, reports Vic Krause, head of Willis North America.

“The economy remains a headwind” as clients manage insurance buying, he says. Property catastrophe rates are up about 5 percent; non-cat property is flat; and casualty is up about 4 percent, he adds.

New business grew by double-digits and the retention rate was about 91 percent.

Plumeri says Willis' North America unit could report a “material” goodwill impairment charge of $1.8 million in the fourth quarter, but the company has yet to complete its annual goodwill impairment testing, which is conducted during the fourth quarter.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.