Global property and casualty insurance rates increased by less than one percent for major lines during the third quarter this year, indicating that prices may be stabilizing, says a report from insurance broker Marsh.

The four-page report, released today, says the cost of insurance for major lines increased 0.9 percent during the third quarter compared to 2012's second quarter.

Marsh says in its Global Insurance Market Quarterly Briefing that its index is a composite of changes in insurance in 20 markets globally over a 12-month rolling period.

The report says that renewal rates rose 1.4 percent in the quarter, the same rate of increase as the second quarter.

Andrew Chester, chief executive officer of Bowring Marsh, says, “With capacity and appetite for well-managed risk still strong, insureds are still able to achieve favorable results on renewal in many lines of business.”

Among some of the report's highlights:

- Financial and professional insurance rates rose 1.9 percent in the third quarter, in contrast to almost flat renewals for the second quarter.

- A benign natural catastrophe season kept increases to an average of 1.2 percent on property-insurance renewals for the third quarter. Insureds with a clean history “were more likely to experience flat renewals.” While the majority of U.S. commercial accounts experienced rate increases on their property-insurance renewals, the lack of hurricane activity “restricted” insurers' efforts to obtain additional increases.

- Casualty-insurance rates rose 1.2 percent on renewal for the period, higher than 0.8 percent in the second quarter. The report notes that “underwriters continue to show caution around particular risks,” such as fracking and cyber liabilities.

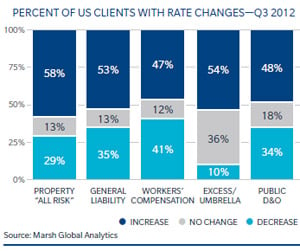

The report says U.S. companies were more likely to experience rate increases than decreases in major lines of insurance for the second quarter in a row.

Turning to excess-casualty lines, Marsh says more clients saw rate increases in this line compared to the previous quarter.

The report says that there are capacity issues concerning the global-energy market as companies are closely managing their exposures in that line of business after substantial losses over the past several years.

“Insurers are struggling to provide sufficient insurance capacity for the growing number of mega-energy projects—those with capital expenditure of more than $5 billion,” says the report. These clients are also willing to self-insure if they cannot find acceptable terms among insurers.

However, midsize energy projects, valued between $500 million and $5 billion, are enjoying the benefits of “fierce levels of competition among insurers.”

Directors and officers insurance coverage in the United States experienced increases of as high as 10 percent, the report says. While the number of securities lawsuits remained stable, increases in legal fees put pressure on insurers.

“Much of this increase can be attributed to larger and more complex cases coupled with higher legal billing rates,” says the report. “As a result, in the U.S. market, primary rates are trending upwards.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.