Lloyd's says its 2012 first-half net income more than doubled compared to last year because of benign catastrophe activity, but the insurance market admits that loss events in the second half of the year could still weigh on year-end results.

Lloyd's says its 2012 first-half net income more than doubled compared to last year because of benign catastrophe activity, but the insurance market admits that loss events in the second half of the year could still weigh on year-end results.

“I am highly conscious that I am writing this during the Atlantic windstorm season,” Lloyd's Chairman John Nelson says in a statement. “Nevertheless, this is our most profitable first six months in five years.”

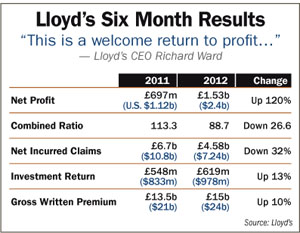

Lloyd's reports its net income rose 120 percent, from £697 million (U.S. $1.12 billion) in 2011's first half to £1.53 billion ($2.4 billion) this year.

Nelson notes that the syndicates had “limited exposure” to U.S. tornadoes and U.K. floods this year and that the “strong figures” were “the result of a benign climate with just a few major events,” citing the sinking of the Costa Concordia earlier this year as one example.

“However, we cannot count on an extended period of low claims activity lasting until the end of 2012,” he says, adding that the markets should likewise not rely on investments “to make up for underwriting deficits.”

Nelson says underwriting discipline remained Lloyd's “top priority” through the first half of the year, and attention to underwriting profit must remain the focus of the markets.

Richard Ward, Lloyd's CEO, says the company's premium-income increase was driven by foreign-exchange rates, price hardening in some lines of business and inflation in insured values.

“I am confident this growth is consistent with the market taking a prudent approach to underwriting in current conditions,” Ward adds.

Lloyd's reports its combined ratio dropped close to 27 points in the first half of the year to 88.7. Net incurred claims were down 32 percent, or more than £2 billion ($3.42 billion), to a total of £4.58 billion ($7.24 billion).

Gross written premium was up 10 percent over last year, or £1.5 billion ($2.4 billion), to £15 billion ($24 billion).

Ward says Lloyd's has enhanced market efficiency with improved “speed and accuracy of claims processes” and adds that further technology improvements are expected in the future. “As we move into the second half of 2012, we will build on these achievements to ensure that Lloyd's is even better placed to fulfill its responsibilities to the market and policyholders alike,” he adds.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.