Customer satisfaction for homeowners insurers climbed to its highest level in 12 years, with satisfaction and loyalty highest among customers who bundled their policies with other insurance products, a recent survey says.

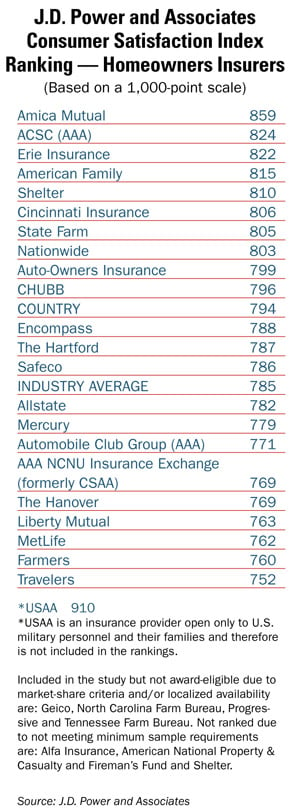

The latest J.D. Power and Associates homeowners-insurance survey of more than 12,600 customers indicates a higher rate of overall satisfaction compared to last year. On a 1000 point scale, homeowners insurance companies averaged a score 785 this year—a 16 point improvement over last year and the highest satisfaction level in the 12-year-old study, says J.D. Power.

The latest J.D. Power and Associates homeowners-insurance survey of more than 12,600 customers indicates a higher rate of overall satisfaction compared to last year. On a 1000 point scale, homeowners insurance companies averaged a score 785 this year—a 16 point improvement over last year and the highest satisfaction level in the 12-year-old study, says J.D. Power.

“The increase in satisfaction with policy offerings is directly related to customer perceptions that insurers are doing a better job in offering the right coverage options at competitive prices when policies are bundled,” says Jeremy Bowler, senior director of the insurance practice at J.D. Power in a statement.

The report shows a gain in satisfaction when policies are bundled together with the same carrier. For customers who insure only their home with an insurer, the satisfaction score was 712. When it is bundled with another policy, the score goes up to 792. The score rises further to 861 when there are four or more products bundled with the insurer.

Not only does bundling lead to greater satisfaction, but it also leads to increased renewals with the same carrier, the survey shows. Retention rates are considerably higher, 97 percent, where customers have four or more products with a company, compared to 86 percent for one additional product. Customers with only homeowners insurance placed with a given company had a 46 percent retention rate.

In an interview, Mark Garrett, research director of insurance for J.D. Power, says the two major drivers for bundling products are policy discounts and customer satisfaction with the company.

The survey further indicates that the relationship between the customer and agent is important as a driver of bundling insurance products, says Garrett. This is especially true where agents take the initiative and sit down with their customers to review their policy needs.

“The trick is building the relationship and having more of that kind of approach where you are having regular touch points with the customer, not just, 'I'm calling you to sell you something,'” says Garrett.

“Agents are playing a big role in driving the recommendation of the product,” Garrett notes. “They play a really strong role.”

J.D. Power's research indicates the when it comes to bundling products, direct writers do a poor job while companies with captive agents are given high marks.

As far as overall customer satisfaction, the J.D. Power report says Amica Mutual was once again at the top for the 11th consecutive year with a satisfaction score of 859.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.