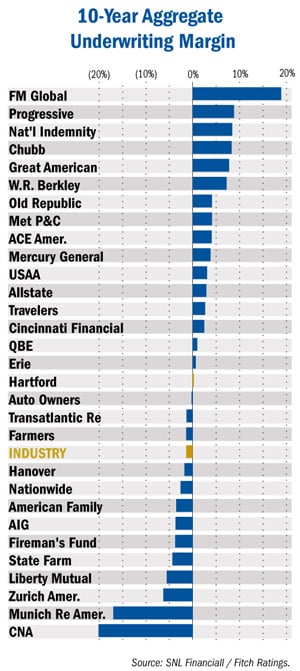

After analyzing five key ratios for 30 top property and casualty insurers, Fitch Ratings says Chubb, Progressive and W.R. Berkley reported the strongest financial performance over the past decade—a period Fitch calls a “bumpy ride” for the industry that saw nearly an entire trip through the market cycle.

Fitch's rankings analyzed five financial-performance measures over both a five-year period and a ten-year period.

The five performance measures are: underwriting margin; operating cash flow ratio; return on assets; return on surplus and internal capital formation.

The five performance measures are: underwriting margin; operating cash flow ratio; return on assets; return on surplus and internal capital formation.

Fitch says these measures were weighted to give greater importance to the factors that provide a “fuller performance measure.” Fitch gave greatest importance to internal capital formation and return on surplus.

Using this weighted average, over the 10-year period Chubb, Progressive and W.R. Berkley were the top three financial performers, followed by F.M. Global, Great American, National Indemnity, Travelers, Metropolitan P&C, Mercury General and The Hartford.

For the five-year period, Great American, Chubb and Progressive were the top performers, followed by Travelers, W.R. Berkley, ACE American Insurance Co., Metropolitan P&C, National Indemnity, Munich Re America, and Zurich America.

Fitch analyzed the insurers' performance from 2002-2011. “This period included a strong hard market, followed by several years of softening conditions that promoted profit deterioration culminating in very poor 2011 results,” the ratings agency notes.

Fitch adds that significant factors during that time were strong operating performance from 2003–2007, weak market conditions and investment challenges since the 2008 economic crisis, and unfavorable catastrophe losses in 2005, 2008, and 2011.

Fitch points out differences in its five-year analysis compared to its 10-year analysis. For example, the ratings agency says that, following restructuring efforts, companies such as Munich Re America and Zurich American Insurance Group fared better in the recent five-year period compared to the 10-year period.

“Still,” Fitch says, “the strongest underwriters tend to perform well within any market condition, and the current ranking of best insurers by financial performance is similar compared to Fitch Ratings' last analysis completed in 2010.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.