The property and casualty insurance market continues to achieve single-digit rate increases but analysts maintain there is little indication drivers are in place for a shift to a hard market.

Towers Watson's Commercial Lines Insurance Pricing Survey, which compares second quarter prices this year to last year, shows that commercial-insurance prices in the aggregate increased by 6 percent during over that time. It is the sixth consecutive quarter aggregate prices rose for all commercial lines, says Towers Watson.

The consulting service says workers' compensation and commercial property experienced increases in the high-single digits, while directors and officers and employment practices liability price increases were in the mid-single digits—a “departure from the relatively flat pricing of the last two quarters.”

The consulting service says workers' compensation and commercial property experienced increases in the high-single digits, while directors and officers and employment practices liability price increases were in the mid-single digits—a “departure from the relatively flat pricing of the last two quarters.”

The figures, based on a survey of U.S. P&C insurers, finds price increases for all account sizes, with mid-market and large accounts seeing higher increases than small accounts

From its recent P&C insurance conference in New York, analysts from Keefe, Bruyette & Woods say the general tone of management-team presentations regarding rate increases can be viewed as “somewhat uninspired,” but “the rate environment does continue to gradually improve, helping to offset the crushing pressures of lower investment yields.”

In a report issued last week, KBW says the consensus appeared to “hover around 5 percent for average rate increases” in most U.S. commercial lines. The rates were about the same as earlier this year, the analysts say, “indicating that there appears to be no momentum or acceleration of rates into a traditional hard market.”

Gradual price increases, KBW says, are being driven by the need for better return on equity by carriers.

KBW says several executives “lamented ongoing economic weakness and pointed out that a real boost to volumes would require a better economy.

The financial performance of insurers is not being helped by the 10-year yield on bonds that is below 2 percent, which is negatively affecting investments through all financial markets.

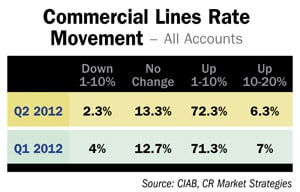

Utilizing some of the data from the Council of Insurance Agents & Brokers quarterly survey of insurance brokers, Charles L. Ruoff, president of C.R. Market Strategies Inc., says if rates remain at their current level of increase, any discussion about rates moving to a hard market “would not be a rational conclusion.”

He notes that the CIAB survey began in the first quarter of 2000 and through that period, prices increased significantly through 2002 before beginning a decline in 2003. Prices dipped below the 1999 level sometime in 2009 and did not climb again until 2011.

This year, rates are coming closer to full cycle, reaching the same level as they were in 1999. The trend, he says, is not pointing to a hard market at this point. He says there are “a reasonable number of [lines of business] where some competition is keeping rates at or below current levels.”

Commenting on the overall state of the insurance market, Jeffrey Carlson, senior consultant, Towers Watson says in an e-mail, “Regarding current market conditions and whether to expect a hard or soft market, it is unclear. A hard market would traditionally be fueled by unprofitable results, inadequate reserves and shortage of capital. I'm not sure we have any of those conditions yet, at least not to a great degree. Our position on reserve adequacy for commercial lines is they are about adequate right now. Our position on commercial lines profitability is that the industry is somewhat unprofitable, but not nearly as bad yet as in prior cycles.”

Updated: Sept. 11, 10:08 a.m. EDT with comments from Jeffrey Carlson.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.