Allstate spokesman Justin Herndon has noticed a few things while driving to New Orleans in anticipation of Hurricane Isaac.

“The gas lines are getting longer,” he says while grabbing something to eat along his route to NOLA—which leads to another observation.

“This is all anyone down here is talking about,” he adds. “In every restaurant, or any place you go in with a TV, the Weather Channel is on. This has people's attention.”

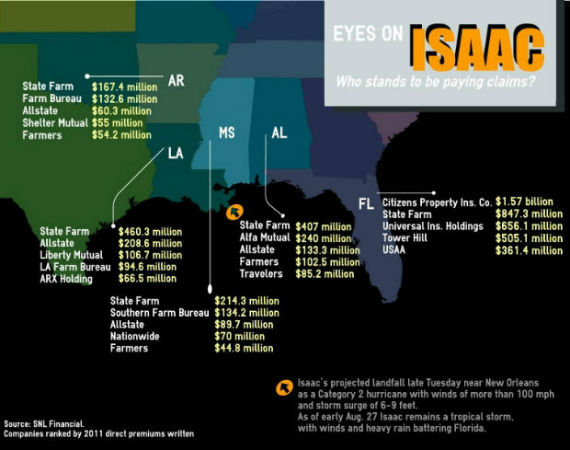

It has the attention of insurers too. Many are gassing up catastrophe-response vehicles and sending more personnel to areas predicted to be among the hardest hit by Isaac, which is forecast to make landfall near New Orleans late Tuesday as a Category 2 hurricane.

Herndon was on his way to the city for some media obligations before turning back to Mobile, Ala.

The insurer's mobile-home-size claims centers are being staged in Mobile, Ala. and Baton Rouge, La.

In addition to the larger mobile claims vehicles, Allstate is using a new tool to handle claims this year—smaller catastrophe response vehicles similar to television news satellite trucks, says company spokeswoman April Eaton.

“They are small enough in scale to drive into some of the heavily-damaged areas as soon as authorities let us in,” she says.

Herndon says the insurer tested the concept last year when Hurricane Irene flogged the East Coast.

State Farm, the largest private provider of homeowners insurance in each of the Gulf States, is staging its mobile claims vehicles in Georgia and Mississippi, says spokesman Gary Stephenson.

“Once Isaac makes landfall, the vehicles will move into impacted areas to allow State Farm policyholders to begin the claims process,” he says.

When a storm's course is reasonably determined, pre-storm planning includes the insurer's advertising, human resources, claims, agency and administrative services units—in charge of temporarily renting space for additional representatives to handle claims.

“There's definitely a playbook,” says Stephenson, who was son his way to Baton Rouge from his office in Little Rock, Ark. “We have people traveling today and we have more standing by in other locations in case this storm shifts.”

Isaac's extended winds and heavy rains affected Florida on Monday. Citizens Property Insurance Corp.—the state's largest writer of property insurance—says it expects 20,000 to 50,000 claims and called in 300 independent adjusters to join 450 adjusters already in the field.

Louisiana Citizens Property Insurance Corp. announced it stopped writing new business while the state's governor has asked coastal residents to voluntarily evacuate.

Isaac could be the storm Louisiana Insurance Commissioner Jim Donelon was worried about when the state's last-resort insurer lost multiple court battles in an attempt to not pay a $105 million judgment against it.

Policyholders had alleged the insurer failed to adjust claims in a timely manner following hurricanes Katrina and Rita in 2005.

Donelon has said a hurricane this season, coupled with the judgment, could significantly weaken the state-run insurer. With this scenario in mind, Donelon called the judgment a “potentially devastating event.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.