Respondents to a three-state survey of producers report that regional personal-lines carriers have an edge over national companies when it comes to overall agency-insurer relationship satisfaction.

Respondents to a three-state survey of producers report that regional personal-lines carriers have an edge over national companies when it comes to overall agency-insurer relationship satisfaction.

Insurance Agents & Brokers (IA&B), which represents agents in the states of Delaware, Maryland and Pennsylvania, recently released its satisfaction survey, which polled agency personnel in those states on four key components of the agency-carrier relationship:

- Products, pricing and underwriting

- Policy service and claims

- The agency/company relationship

- Technology

Tim Wonder, IA&B's senior director of legal and industry affairs, points out that regional carriers have outpaced national carriers on a consistent basis over the years.

In this year's survey, using a scale of 1 to 4 (with 1 being the lowest score) national carriers (defined as a carrier operating in 35 or more states) received an average score of 3.123. Regional I carriers (operating in one to 10 states with less than $100 million in direct written premiums) recorded a score of 3.244. Super-regional insurers (operating in 11 to 34 states) scored 3.209.

Regional II carriers (operating in one to 10 states with more than $100 million in direct written premiums) ranked highest with a score of 3.27.

IA&B admits it is at a loss as to why regional personal-lines carriers are favored among producers in those states. “Why the regionals do better overall, we just don't know,” Wonder tells NU. “Maybe there is the sense that the regionals have a stronger relationship [with agencies] than the nationals. [That] may have to do with making it easier to do business with them, or their sales representatives may make more visits to the agency.”

The scores also revealed that the regionals outpace the nationals in almost all of the four relationship categories.

Despite having superior resources, national companies even trailed most regionals when it comes to technology, scoring 3.029 compared to 3.115 for super-regionals and 3.114 for regional II carriers. Nationals did beat regional I companies in this area, though, as the latter scored 2.994.

IA&B has conducted the survey on a biannual basis since 2004, asking about both personal and commercial lines. This is the first year in which participants were asked to rate personal-lines carriers only; the commercial-lines survey is scheduled for 2013.

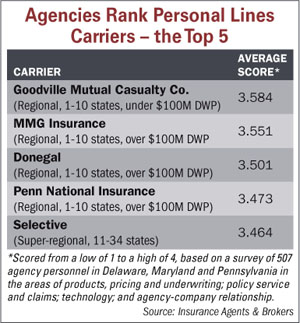

Of the carriers included in the 2010 survey, only 20 percent improved in satisfaction, while 80 percent declined. The company receiving the highest overall rating was Goodville Mutual Casualty Co. (a regional I carrier), followed by MMG Insurance (a regional II carrier).

Rounding out the top five were:

- Donegal (regional II carrier)

- Penn National Insurance (regional II)

- Selective (super-regional)

At the bottom of the list were MetLife Auto & Home, ranked 37, and Allstate Insurance Co., ranked 38.

Of the 13 national carriers scored in the survey, Cincinnati Insurance (ranked 6), Kemper (ranked 7) and Travelers (ranked 8) were rated highest.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.