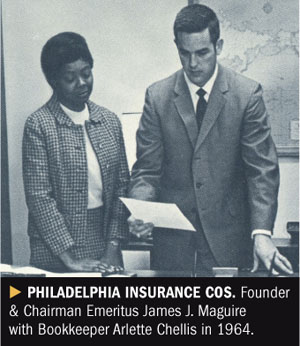

Celebrating its 50th birthday this year, Philadelphia Insurance Cos. has found five decades of success by hewing closely to the strategic vision of its founder, James Maguire Sr., who entered the industry as an agent selling life insurance to deaf people during the early 1960s.

Celebrating its 50th birthday this year, Philadelphia Insurance Cos. has found five decades of success by hewing closely to the strategic vision of its founder, James Maguire Sr., who entered the industry as an agent selling life insurance to deaf people during the early 1960s.

“My dad identified that market as an underserved niche where he could differentiate himself,” says his son Jamie Maguire Jr., who now serves as chairman & CEO. “So he set up his own insurance agency and instead of being a generalist, he [focused on] certain areas where he had competitive advantages and developed creative products that set him apart.”

Today, Philadelphia pursues the same specialty strategy, providing P&C coverage to more than 100 niche markets spread among eight commercial sectors including health care, child-care facilities, nonprofits, security-guard services and automobile rentals.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.