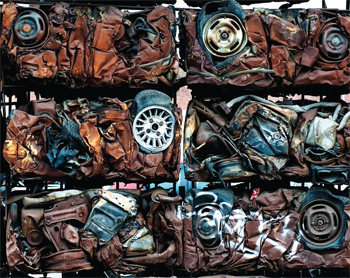

Depending on the catastrophe activity and incidence of vehicular accidents, a large insurer may process an excess of 100,000 total loss auto claims in a given year. This translates to a six-digit opportunity to recoup a portion of claims payouts while fostering good will with customers.

Depending on the catastrophe activity and incidence of vehicular accidents, a large insurer may process an excess of 100,000 total loss auto claims in a given year. This translates to a six-digit opportunity to recoup a portion of claims payouts while fostering good will with customers.

From the perspective of a total loss, the assignment of salvage must be made as early as possible, preferably at FNOL. This, of course, requires the insurer to swiftly categorize the vehicle as a total loss after weighing factors such as the age of the vehicle and extent of damage inflicted.

Partnering with the right salvage specialist represents half the battle. As we'll discuss, insurers must also employ the appropriate technology platform to optimize work flow in order to avoid unnecessary bottlenecks and towing expenses.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.