NU Online News Service, July 9, 2:33 p.m. EDT

As the number of catastrophe bonds has grown over the past five years so has the use of industry triggers to determine the release of capital, according to a report from Property Claim Services.

For the first half of 2012, the catastrophe bond market “has been exciting” says the report from PCS, a subsidiary of Jersey City, N.J.-based Insurance Services Office. Catastrophe bond activity is up with several large bond issuances closing and healthy mix of new entrants and veteran issuers.

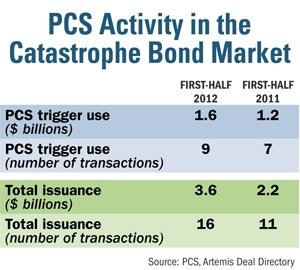

PCS goes so far as to conjecture that 2012 could mirror the record year of 2007 when $7 billion worth of bonds came to market. So far, for 2012 there have been $3.6 billion of catastrophe bonds issued compared to $2.2 billion for the same period last year. That is a total of 16 transactions for the first six months of this year to compared 11 in 2011.

The use of PCS triggers, which determines when the catastrophe bond should be released to the issuer, rose from 7 last year to 9 this year with average value in bonds growing from $171 million for the first half of 2011 to $178 million for the first half of 2012. The transaction value of the PCS index grew 33 percent from $1.2 billion to $1.6 billion.

PCS explains that other methods issuers use as triggers are the indemnified loss; parametric—such as the National Hurricane Center indicating a category 4 hurricane at landfall, or a catastrophe modeled figure based on projected loss.

In a statement, Gary Kerney, assistant vice president of PCS says, “Is 2012 like 2007? That's the big question everyone seems to be asking.” He adds, however, that, “At the beginning of the hurricane season, it's just too soon to tell. One catastrophe could change everything.”

The report notes that while the majority of bonds still cover U.S. wind and earthquake, issuers are beginning to “address more international risks” such as Akibare II Ltd. covering Japan typhoon.

Maturities are also becoming longer, as more bonds are going from three year to four year maturities.

The report says the catastrophe deal pipeline for the third quarter is expected to be a “robust year for issuance to continue, but is typically the “quietest” part of the year due to the hurricane season.

“Even if issuance levels wind up similar to those of 2007, much has changed,” the report says. “The catastrophe bond market has evolved, along with investor appetite. [Maturities] are increasing, and the perils covered are broadening. The array of triggers available is expanding, yet a core set of triggers appears to appeal to many issuers.”

A report from Guy Carpenter in May on catastrophe bond maturities in 2012 noted that the expectation is that there would be little impact as new money continued to flow in.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.