In 2011, buyers enjoyed a relatively soft market for their Employment Practices Liability Insurance (EPLI). But the pricing pendulum is swinging this year, with insureds seeing, in some cases, increases inching into double-digit territory.

For all businesses, regardless of size, decreases in EPLI pricing last year outweighed increases. According to insurance broker Marsh's most recent benchmarking trends report on EPLI, 44 percent saw their EPLI insurance decrease by an average of close to 2 percent, while 35 percent saw no change; just 21 percent saw their rates increase.

For all businesses, regardless of size, decreases in EPLI pricing last year outweighed increases. According to insurance broker Marsh's most recent benchmarking trends report on EPLI, 44 percent saw their EPLI insurance decrease by an average of close to 2 percent, while 35 percent saw no change; just 21 percent saw their rates increase.

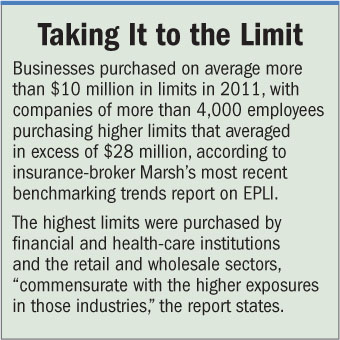

Larger companies, especially, benefited from carrier competition on their EPLI risk in 2011, according to the Marsh report: 58 percent of large organizations (4,000 or more employees) received rate decreases in their coverage last year. That translated into close to 4 percent average rate decrease for the year. Only 14 percent of large companies saw rate increases; 28 percent saw no change.

Marsh notes that “double-digit decreases were typically reserved for clients with positive claim history, minimal reduction-in-force or mergers-and-acquisition activities, and best-in-class policies and procedures, particularly with respect to anti-discrimination, diversity, and training senior management around those issues.”

This year, however, is a different story, with some carriers successfully securing double-digit increases to make up for years of soft prices and subpar underwriting results.

At Liberty International, rates are definitely firming, says Melissa Mattioli, vice president of Employment Practices Liability. She has seen average increases of 10 percent for clients, depending on the exposure.

A report by Betterley Risk Consultants indicates the need to raise rates in EPLI may be greater than in other specialty lines. President Richard Betterley says carriers tell him rate increases are being driven by claims generated by the recession and by increases in defense costs.

“Years ago, brokers were telling carriers they couldn't sell increases,” Betterley says. “They've changed their tune, and are saying, 'Just don't go above 10 percent.'”

In other good news for insurers and producers, the overall demand for EPLI cover is growing.

Because of an increase in Equal Employment Opportunity Commission (EEOC) enforcement actions, more small and midsize companies are purchasing EPLI coverage for the first time, according to Adeola Adele, a Marsh senior vice president and the firm's national EPLI product leader.

Increased staffing at the EEOC and a greater commitment of resources helped the agency reduce its pending files by 10 percent. That activity pushed recovery on behalf of employees to more than $365 million.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.