The current climate is gravitating toward pushing captives—including single-parent captives, association captives and agent-owned captives—to appointing experienced, independent directors to their boards.

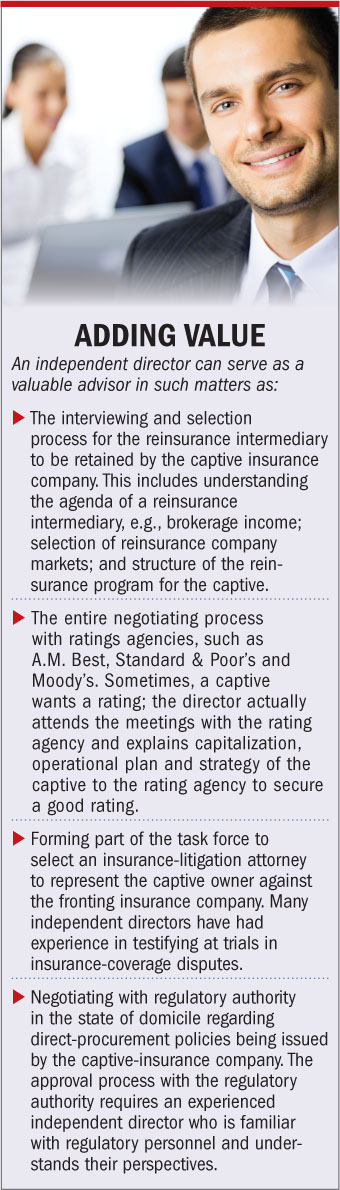

Regulators (including the National Association of Insurance Commissioners and Bermuda Monetary Authority) and ratings organizations (A.M. Best, Standard & Poor's) have come out in favor of the movement toward the appointment of independent directors. They believe independent directors add value by providing experienced guidance to captive owners that is separate and distinct from a captive's other advisors, such as managers, lawyers and accountants.

Regulators (including the National Association of Insurance Commissioners and Bermuda Monetary Authority) and ratings organizations (A.M. Best, Standard & Poor's) have come out in favor of the movement toward the appointment of independent directors. They believe independent directors add value by providing experienced guidance to captive owners that is separate and distinct from a captive's other advisors, such as managers, lawyers and accountants.

Independents do not have conflicts of interest; they often present a wealth of experience different from others on the captive's board; and they typically possess a broad captive-insurance perspective that is rarely matched. When working with other directors that have complementary expertise, an independent director can present a valuable perspective from which most captives would benefit.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.