Mobility continues to soar over the technology world as well as provide business value to insurers because of its direct connection to business transactions and core systems.

Mobility continues to soar over the technology world as well as provide business value to insurers because of its direct connection to business transactions and core systems.

"It's a way to put new channels out there and extend core systems to the marketplace," says Mark Breading, a partner with the research and advisory firm Strategy Meets Action. "There has been a steady increase in the business value for insurers through mobile technology."

Insurers as diverse as Progressive Insurance and Electric Insurance have worked diligently through the past year to find ways to improve connection with their business partners, customers, and potential customers as well as extend their connection. Insurers have for years stated their case to be valued partners to customer wherever and when ever the customer wants to reach them. Mobile technology has taken that promise of connectivity to a new level.

When Electric Insurance began studying requirements for a mobile application, the company spoke with solutions provider Agencyport about what the vendor was proposing to do in the mobile space and CIO Tom Stumpek discovered Agencyport's plans fit with Electric's requirements.

"We wanted to develop an app in the iOS platform and they already had the foundational code," he says. "There were some features we wanted to serve our customers such as roadside assistance and windshield repair. They had the core components and we had some integration work on the back end, but this seemed the most logical way for us to go. The cost and implementation time were good—only eight weeks for the whole project. By IT standards, that's pretty quick to market."

Progressive Insurance prides itself on providing insurance through multiple channels. With technology benefitting both the direct and agency channels, Progressive is looking to capitalize on some of its mobile technology investments to serve multiple channels.

"We are having success in tools that cross over," says Matt Lehman, mobile business leader for Progressive. "As we build out certain capabilities, clearly we are looking for those to be channel agnostic. When you look at the servicing and claims' capabilities that are built into both our apps as well as our mobile Web—things like severe-weather text alerts or the ability to view policy coverages—we want those to be available to all customers regardless of how they choose to work with us."

WHAT CUSTOMERS WANT

Progressive isn't afraid to build certain capabilities strictly for one of its distribution channels, but Lehman believes it all comes down to ways for customers to use mobile technology to make the insurance process easier.

"If a customer chooses to work with one of our 35,000 independent agents, that's great and we want to put tools like the new FAO (ForAgentsOnly) effort into agents' hands so they can be mobile," says Lehman. "On the other hand, if a customer wants to work directly with us and use the device in their hands, we want to offer tools that will make that easy as well. We certainly look for crossover opportunities and in certain cases we may release something for the direct channel, which ultimately will cut over to the agency channel as well."

As Progressive goes through the process of developing these tools, one thing that is consistent between both channels, according to Lehman, is communicating with the respective audiences along the way. "When we are building a direct experience, we are going to listen to what our existing customers or prospects are telling us and think about ways to optimize that experience," he says.

It's the same with agency tools.

"A lot of these applications were vetted with our agency technology council over the last year, so we understand from a mobile standpoint what they are looking for. Are [agents] more apt to sit across the table from a client or prospective client with a tablet or a smaller device? We heard they were going to use tablets so that's why we went out and built this [FAO] capability on iPads today and it's coming to Android tablets in the not-too-distant future."

The goal for Progressive is to enable agents to bring new clients onboard so they can quote and bind policies in a similar manner to what they might do at a desktop.

"They can certainly provide a rate, go through the buy process, provide the basic servicing capabilities, and run reports so [the agents] can look at the makeup of their Progressive customer base," says Lehman.

CARRIER USES

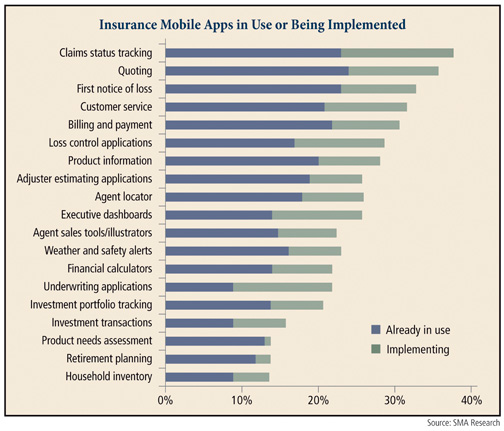

Insurers are finding ways to provide agents, adjusters, and other third parties with mobile capabilities, according to Breading.

"There are interesting things going on in terms of iPad apps for adjusters and even life insurance companies," he says.

In Canada, he points out, paramedics that collect medical data for life insurers typically are independent and often represent multiple companies. An iPad app was developed so the data they are collecting is uploaded in the field.

"They just select the carrier and the company logo is on the form," says Breading. "It's pretty much the same data being collected from all the policyholders, so it is straightforward and simple."

Some insurers are using mobile technology for loss control inspections.

"They don't just fill out automated forms; they can take a picture of the property and attach it to the file," said Breading.

Progressive earlier this year went outside its own research and development area to purchase software from technology vendor Mitek to help boost the direct line by allowing customers to submit a photo of their driver's license and the VIN for a particular vehicle and get a rate back through their smartphone.

"We still need all those data pieces about [a customer] in order to provide an accurate rate," says Lehman. "We also are looking at ways to make that input process easier. When you look at how mobile technology is evolving, one of the big ways is around the use of the camera—making deposits to your bank, scanning a QR code—so we wanted to expand on that."

The image capture allows a customer or potential customer to take a picture of their driver's license for prefill and another picture of their insurance card to get the VIN or scan the VIN off the car itself.

Progressive's history of using technology and trying to be first to market to make things easier for customers and independent agents means Progressive often gets approached by companies with possible software solutions, explains Lehman.

"This was a situation where we were looking at ways to use mobile technology in the quote process," he says. "We saw what Mitek was doing with remote check deposit and we were able to strike a really good partnership between us. We bring a lot around the user experience with a powerful rating engine in the background."

Progressive seeks to deliver an accurate, viable rate, not a ballpark rate based on what Lehman calls "a ton of assumptions that likely will change. We want to get you through the process quickly and easily and we want to give you a rate you can purchase right there on the phone if it is good for you."

Progressive is happy with how the technology and the back-end systems are working together and the carrier looks forward to growing this solution.

"It's all about speeding up the process of getting a rate and making it easier," says Lehman. "Will we expand that over time? Today we are in the introductory period. We are looking to expand it in more states and we are hearing good results from those that have used it, but right now we are focused on making it as good as possible for those early adopters."

Fitzgerald believes the new Progressive function goes beyond the coolness factor.

"It really saves people steps and makes it easier for them to access the carrier," he says. "It's a great example of not just taking an existing process and putting it on a mobile platform, but really being able to make it work. You add the prefill and you know they are on a public network so you can pull in that other data. That's innovation, not just improvement."

OTHER USES

One of the mobile features that Stumpek believes will make Electric stand out is visitors can find an electric vehicle charging station through the Electric app.

"We found that was an emerging market for us," he says. "Since we insure GE fleet services, one of the value-adds is the charging locater. We've put a GE charging station in front of our building. Electric vehicles are taking off and charging stations are needed."

Existing customers can log-in through the Electric app with their user ID and password and pull up all their insurance information. Once they are logged in, the mobile account has their information and allows customers to perform tasks such as processing an auto claim.

"It's a neat application where you select a car model and there's a thumbnail of it," says Stumpek. "You tap on the areas damaged and add your own photos. It is sent to our claims system and we immediately start a link. The other thing we do is glass replacement through the app and you can schedule your appointment. These are some of the services we want to provide our customers."

Down the line, Electric is looking at a number of ideas, but the carrier didn't want to start out with too much going on.

"We have close to 2000 downloads so far," says Stumpek. "The second day we actually filed a claim and the customer said it was seamless. A quoting system can be fairly complex, especially if you write in all 50 states."

EXPANDING ITS REACH

EXPANDING ITS REACH

Breading believes mobile technology is becoming more pervasive as it moves down from the tier one companies. There are many tier-two insurers—$1 billion to $5 billion in direct written premium—that have mobile apps in the marketplace.

"There are not many of the tier-three insurers that have custom mobile apps," he says. "The most they may have done is to make their Website mobile friendly so people can use the existing Web content on their smartphone. That's a preliminary stage before creating custom mobile apps and definitely is a good first step."

Breading sees plenty of vendors that can help smaller carriers move into mobile and maintains that those carriers might be foolish to try and do it themselves.

"There are a lot of companies that provide those translation capabilities," he says. "The same is true for mobile apps. There are a lot of vendors out there that can test [the product] so they know it will work on all the current platforms and they are going to take advantage of the interaction capabilities. You are not just building a Web-based HTML application. You want something that offers touch-screen capabilities."

Independent agents are saying they want to be mobile, according to Fitzgerald.

"In the surveys we've done around producer technology, they say the number one thing is give them what they need or give the customer what they need so they can enjoy better customer service," he says. "Mobile fits right in there."

Chad Hersh, a partner with the research and advisory firm Novarica feels it is important that agency writers offer mobile connectivity to their customers.

"You can't afford to skip the consumer channel because consumers expect you to behave like a direct writer whether you are or not," he says. "If you are an agency writer, there is an expectation that you are going to both provide access to the agent to support you and when the agent is not available, you are going to offer options. Technology when you want it; people when you don't. I think everyone understands that if you are a direct writer you need to provide an agent-like experience and if you're an agency writer you have to provide a direct-like experience. People want what they want when they want it."

OPERATING SYSTEMS

Many companies are gambling on one mobile operating system taking over the market, but Lehman points out the mobile market is still too fractured with key players developing their own systems.

"As far as agents and what the mobile FAO will cover, certainly iPad has the lion's share of tablet usage today," says Lehman. "We are seeing Android make some inroads with the Kindle Fire, for example, the Motorola Zoom, and the Galaxy Note tablets. By offering similar functionality, those operating systems will cover the vast majority of the tablet market."

The handheld market is more evenly split, according to Lehman.

"We see pretty broad coverage on both iPhone and Android," he says. "Our goal there when we think about the consumer is to be present from the app space with iPhone and Android apps. We have a robust mobile Web offering as well and that is device agnostic, so if you have a BlackBerry or Windows phone you can access the mobile capabilities."

Choosing which operating system to build an app can be a tough call for an insurer.

"What you are looking for when you build an app is the cost and the market share," says Hersh. "If you are building a fairly robust app like Progressive's latest with the capture-the-image of the driver's license to get a quote, it's surprisingly easier to do that on an iOS device because you know what hardware is there. Every iOS device has a camera except for the original iPad. You can build an app for the iOS that says it works for everything but the original iPad. When you build something for an Android phone you are looking at hundreds of variations and Android tablets have dozens of variations. They all have different hardware specs and different versions of Android. It's much harder to build for that."

Novarica typically advises insurers that if they only have resources to build for one operating system, do iOS. If they have resources to do two, do iOS and Android.

There are platforms that will allow carriers to build the underlying application and then port it to both operating systems, according to Hersh, and there is the option for certain smaller carriers who want to do both can create an application that runs an HTML5 Website—a mobile Website that looks platform specific to the end user, but in reality is more a skin.

"The problem with that kind of app is it runs remotely and people aren't always connected," says Hersh. "People want their apps to work on or offline within reason. That being said, for security purposes most carriers don't want any data stored on a phone or tablet anyway, so it is a reasonably appealing option. Things are slower to load and it is not going to be as cool, but it solves problems from a cost perspective and a platform perspective."

One of the drivers to selecting the iOS system was that a lot of Electric's known customers—mainly GE employees—have a mobile device through GE and it's usually either a Blackberry or an iPhone.

"We didn't feel it was that important to get it out on the Android platform right away," he says. "I saw some data from Forrester that Android will surpass iOS devices in the not-too-distant future, so it is on our roadmap to get on the Android platform."

WHO'S DOING WHAT

Fitzgerald sees software companies working to get their existing offerings on a mobile platform, although new functionality is not the priority for now.

"It's not very innovative, but they know they need to have their solutions on the mobile platform," he says.

As for the carriers, having some mobile connectivity is a necessity and is expected of them by consumers. Fitzgerald worries about smaller carriers and the position they have been placed in.

"This is another example where the smaller and regional carriers that haven't updated their technology platforms are going to be at a further disadvantage," he says. "Some carriers got to the Web in a clunky manner with an old infrastructure behind it. It's more difficult to take that approach with mobile and be sustainable. Mobile is another wedge being driven between the technologically prepared and the non-technologically prepared organizations."

The majority of mobile technology development is being done in house. Hersh explains it is not a big stretch for an IT staffer to go from being a typical Web developer or application developer to developing mobile apps.

"With something cutting edge like image capture and recognition, it may be best to go outside," he says. "A camera on a particular device may always be a challenge. There are certain things you want to have core competency around, but there are pieces that are overly complex, just like with regular application development."

Hersh agrees it is another area where mid-size and smaller carriers are at risk.

"Consumers don't expect any less of them because they are small," he says. "Will a big direct writer always have a better, snazzier app? Sure. Do consumers necessarily care about that? No, as long as they can get what they need to get done on the app, they are generally going to be happy. That being said, historically what we've seen happen is vendors—particularly policy vendors—tend to add these functionalities as a differentiator so they can go to carriers and say, 'If you use our system you would have a mobile app by now.' I think we'll see more of that from policy vendors, portal vendors and stand-alone app vendors come out stronger in the market. There will be options, but you have to have something out there now or really soon."

THE FUTURE

Mobility has to move up on the priority list for carriers that haven't started yet, according to Hersh.

"It's likely that the iPad 3 will cause another surge of tablet sales," he says. "Phones coming out are quad core and the average consumer doesn't even have a quad core desktop yet. The power of these devices is bordering on more than we need. My phone has better bandwidth than the fiber optic connection in my house. It has a dual-core processer and puts the resolution on my desktop to shame. Consumer expectations are growing and their general computing needs are going to be met by apps. It's a good sign when you see Geico, Progressive, and Bank of America all touting mobile apps in advertisements. That means others will have to follow."

The insurance industry is in a period of unparalleled technology adoption and innovation, according to Lehman.

"Given our lineage of trying to be at the forefront of using technology to make insurance easier, it's an exciting time for consumers as well as independent agents who can embrace this technology," he says.

Breading believes there is going to be a lot of progress in mobile implementations this year.

"Mobile is moving way beyond the experimentation stage," he says. "Real, live, beneficial apps are put up not just for customers, but for business partners and employees. A lot of companies—the big ones especially—that have been in this for a couple of years now are looking for ways to bundle the content so they can have rich mobile apps that provide value for the users."

Breading predicts the number of carriers using mobile won't increase significantly this year, but he feels the richness of the mobile functions will improve.

"If you are a $250 million insurer—even a half billion dollar premium insurer—it is really hard to figure out how to prioritize the advanced technology," he says. "You have just enough budget, resources, and skills to maintain your core systems to run your business. My advice is to not look at the lines as a mobile app, but as mobile functionality that is being delivered. I don't expect to see a huge shift in terms of carriers using these because if you look at the smaller insurers—of which there are a lot—they are just not going to be there yet. The ones that have already experimented are going to go to the next step and make it richer and improve the user experience and user interface."

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.