Three subjects dominated discussions among executives and risk managers in Philadelphia at this year's Risk and Insurance Management Society convention: pricing, Business Interruption and Cyber risk.

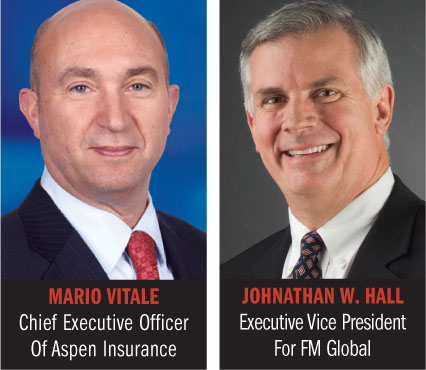

Regarding pricing, Mario Vitale, CEO of Aspen Insurance, says there is clear evidence the market is firming, but he notes that no one is using the term “hard market” in their conversations about rate.

Regarding pricing, Mario Vitale, CEO of Aspen Insurance, says there is clear evidence the market is firming, but he notes that no one is using the term “hard market” in their conversations about rate.

Last year's catastrophe losses and low-investment yields have taken their toll, he says. However, the market is in a position now where a major event could shift it from firming to hardening. But putting an exact number on what size that loss event would have to be to move the market is difficult, he adds.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© Touchpoint Markets, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more inforrmation visit Asset & Logo Licensing.