Nearmap’s AI-powered models approved in 27 markets

Insurers can leverage the predictive scores to help price risk.

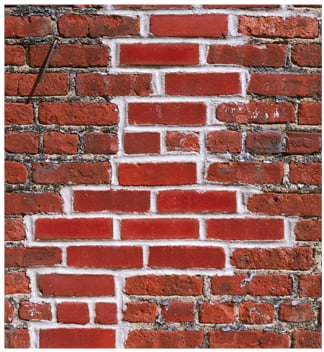

One of the most common questions I receive regards matching. Typically what happens is there is a loss on the premises that affects a portion of the roof, carpeting, flooring, siding, or other material, and the carrier wants to replace only the damaged section. This is acceptable if matching components can be found. However, it is not uncommon for that particular type of shingle or carpeting to be discontinued so an exact or even close match is unable to be made.

One of the most common questions I receive regards matching. Typically what happens is there is a loss on the premises that affects a portion of the roof, carpeting, flooring, siding, or other material, and the carrier wants to replace only the damaged section. This is acceptable if matching components can be found. However, it is not uncommon for that particular type of shingle or carpeting to be discontinued so an exact or even close match is unable to be made.

Often the carrier wants only to replace the damaged section of roof or carpeting, while the insured wants to be restored to what he or she had before—namely, a matching roof or carpet. The carrier bases its argument on a few sections of policy language. The first is under Section I: Perils Insured Against, where the policy states that “we insure against direct physical loss.” The second part of language is under the loss-settlement section of the ISO homeowners’ policy, where it refers to “that part of the damaged building.” Certain carriers maintain that these two sections of language indicate that only the damaged portion needs to be replaced, thereby excluding any undamaged portions that would make the property match.

Settlement OptionsAnother section of language in the loss-settlement options is where the policy pays the lesser amount of policy limits—either the amount actually spent to repair or replace the property, or the replacement cost of that part of the building damaged with material of like kind or quality. Again, carriers use this section to pay for only the damaged portion of the building. However, the like kind and quality statement does present an issue. For instance, if the type of shingles or carpet is no longer available, then it is impossible to replace just the damaged section with “like kind and quality.”

None of these arguments comply with the principle of indemnity where the insured is restored to what he had before the loss. If the insured had a matching roof or carpeting before the loss, and after the loss the roof or carpeting is mismatched, then the insured is not properly indemnified.

Already have an account? Sign In Now

NOT FOR REPRINT

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.

Insurers can leverage the predictive scores to help price risk.

New car buyers are in a financial squeeze.

New technology juggles storm water risk, urbanization and climate change.

White Paper

Sponsored by Vortex Weather Insurance

Parametric Hurricane Insurance: A Strategic Solution for Agents and Brokers

Hurricane-related financial risks can leave businesses vulnerable due to gaps found in traditional insurance policies. Parametric hurricane insurance provides a proactive solution for your clients to recover from hurricane-related financial losses quickly. Learn how this innovative coverage model offers transparent payouts based on measurable storm conditions--helping your clients bridge critical financial gaps when they need it most.

White Paper

Sponsored by Vortex Weather Insurance

Hourly Rain Insurance: A Strategic Solution for Agents and Brokers

Rain-related business disruptions can be costly for your clients. Parametric hourly rain insurance offers a proactive approach to mitigate financial losses from weather conditions. This data-driven solution delivers fast, automated payouts when rainfall thresholds are met, ensuring your clients are protected when they need it most.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.

Copyright © 2025 ALM Global, LLC. All Rights Reserved.