NU Online News Service, April 12, 2:52 p.m. EDT

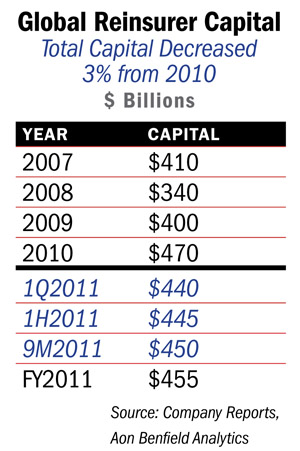

Global-reinsurer capital declined 3 percent in 2011 over the previous year as first-quarter catastrophes and reduction in capacity from government programs took a big chunk out of the total, says reinsurance broker Aon Benfield.

However, the Aon Benfield Aggregate report for full year results 2011 says its review of the 28 leading reinsurance companies reveals an increase of close to 2 percent for the group on a year-over-year basis in shareholders' funds despite the impact of first-quarter catastrophes.

In the first quarter, catastrophes caused reinsurance capital to drop 6 percent from full year 2010 level of $470 billion, to $440 billion. In the next three quarters, capital rose 1 percent in each quarter, reflecting “retained profit reported by traditional reinsurers,” the report says.

In the first quarter, catastrophes caused reinsurance capital to drop 6 percent from full year 2010 level of $470 billion, to $440 billion. In the next three quarters, capital rose 1 percent in each quarter, reflecting “retained profit reported by traditional reinsurers,” the report says.

“The reinsurance sector remains strong after a testing year in 2011, and continues to provide very efficient underwriting capital to insurers,” says Mike Van Slooten, head of Aon Benfield's international market analysis team in a statement. “The volatility sustained by reinsurers was substantial and materially improved the earnings and capital reported by insurers affected by unusual frequency and severity of events occurring in 2011. The value proposition of reinsurance has rarely been so clearly demonstrated.”

The Aon Benfield Aggregate (ABA) of 28 reinsurers reports shareholders' funds of $251 billion, an increase of $4 billion from the prior year's $247 billion.

The growth was driven by a few companies, principally Swiss Re, White Mountains, Hannover Re and ACE, the report says. The vast majority of other companies in the index saw shareholders' funds drop, some as much as 30 percent.

Gross property and casualty premiums written by the ABA group rose more than 11 percent to $136 billion from the prior year's $122 billion, the report says.

The group showed a combined ratio of 108.2 for 2011, a deterioration of 13.5 points from the 2010 combined ratio of 94.7.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.