NU Online News Service, March 26, 12:31 p.m. EDT

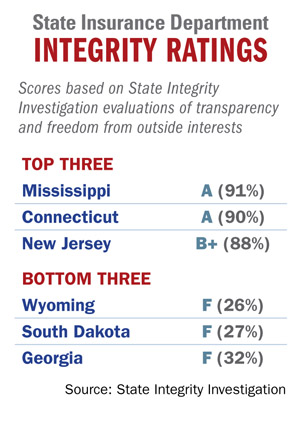

Sixteen state insurance agencies failed a national state-evaluation test, but Mississippi came out on top of the 50-state review.

The State Integrity Investigation, a research project sponsored by The Center for Public Integrity, Global Integrity and Public Radio International, had reporters in all 50 states evaluate the corruption risk, covering issues of transparency, accountability and ethics enforcement in individual states.

The report gives an overall evaluation of individual states and breaks the results down into several categories that include state insurance commissions.

The report gives an overall evaluation of individual states and breaks the results down into several categories that include state insurance commissions.

Wyoming's insurance department was at the bottom of the list with a score of 26, earning it a grade of F. Fifteen other departments received the same letter grade, despite posting higher number grades.

On a scale of 0-100, the Wyoming insurance department received 0 for citizen access to the asset-disclosure record of the insurance commission and disclosure of documents filed by insurance companies. It received a score of 33 for the department avoiding conflicts of interest and a 37 for both protection from outside influence and effectiveness of conflict-of-interest regulations.

Its highest score of the six evaluation questions was 50 for: "Does the commission have sufficient capacity to carry out its mandate?"

By contrast, Mississippi's insurance department scored an "A" for its 91 percent evaluation. The state received 100 percent scores for four questions and 81 percent for disclosure of documents filed by insurers. Its lowest score, 66 percent, was for citizen access to records of the department.

In a statement, Mississippi Commissioner of Insurance Mike Chaney says, "I am proud and honored that this report recognizes the outstanding effort the department makes in enforcing the laws and regulations in the state while providing our citizens with the maximum amount of consumer protection."

He went on to say, "Every day our dedicated staff works hard to fulfill the goals of the Mississippi insurance department in creating the highest degree of economic security, quality of life, public safety and fire protection for the state's citizens at the lowest possible cost. We are committed to providing assistance to consumers in a timely, caring and ethical fashion."

Mississippi's insurance department was followed by Connecticut, which was also graded "A" and earned a score of 90.

Next came New Jersey, graded "B+" with a score of 88 percent. The state of Washington's department also earned a "B+" with a score of 87.

In overall state rankings, New Jersey was the highest with a grade of "B+" and score of 87 percent, while Connecticut ranked second with a grade of "B" and score of 86 percent. Washington was ranked third with a grade of "B-" and score of 83.

Georgia earned the lowest overall state score of "F" and 49 percent.

The 15 other state insurance departments receiving failing grades were:

- South Dakota—Score 27 percent

- Georgia—Score 32 percent

- New Mexico—Score 41 percent

- Nevada—Score 43 percent

- Idaho—Score 47 percent

- Michigan—Score 50 percent

- Maine—Score 51 percent

- Maryland—Score 52 percent

- Arizona—Score 53 percent

- Kansas—Score 55 percent

- South Carolina—Score 55 percent

- North Dakota—Score 57 percent

- Hawaii—Score 57 percent

- Colorado—Score 58 percent

- Texas—Score 58 percent

A spokesman for the National Association of Insurance Commissioners says the leadership declined to comment on the evaluation.

A request for comment from the Wyoming Insurance Department was not immediately returned.

Updated: 4:30 p.m. EDT concerning comment from the Wyoming Insurance Department.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.