According to ALIRT Insurance Research, underwriting results for the ALIRT P&C Composite deteriorated sharply in 2011 despite considerable reserve releases, due mainly to catastrophe losses.

The ALIRT P&C Composite consists of the 50 largest U.S. personal and commercial-lines insurers, according to the Windsor, Conn.-based firm.

In general, ALIRT says earnings are lower, as is surplus, while investment returns are falling.

On the following pages, ALIRT provides charts that break down in detail the underwriting results, investment results, reserve development, written-premium changes and surplus changes for the ALIRT P&C Composite.

All charts were created by ALIRT Insurance Research and used with permission.

Click “Next” to begin the slideshow.

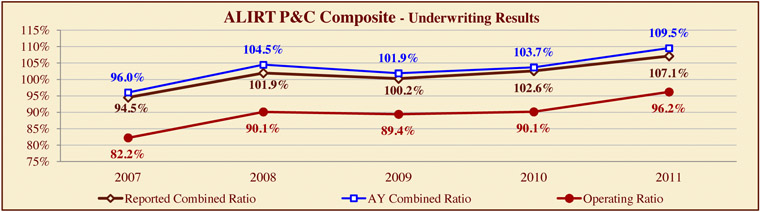

2011 accident year underwriting results deteriorated sharply and, despite substantial reserve releases, the reported combined ratio was also significantly worse in 2011, due to considerable weather-related losses, according to ALIRT. The 2011 operating ratio worsened, reflecting the substantial catastrophe losses and relatively weaker investment income.

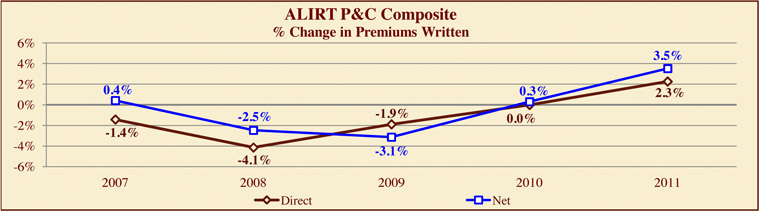

Revenue is recovering, ALIRT says, with modest-to-moderate growth in both direct and net premium after bottoming out in 2008-2009.

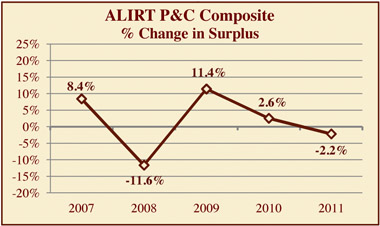

Composite surplus grew 2.6 percent during 2010, but fell 2.2 percent in 2011 due to weaker earnings and sizeable dividends paid, ALIRT notes.

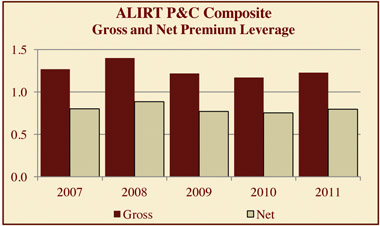

Premium leverage remains fairly low and is leveling off, ALIRT says.

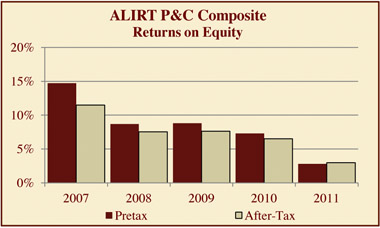

Returns on equity continue to decline, according to ALIRT, falling sharply in 2011 due to catastrophe losses, and in spite of a lower equity (surplus) base.

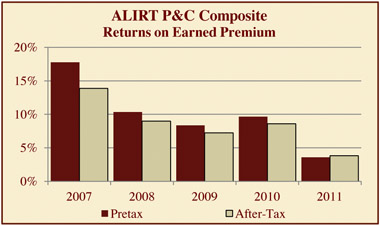

Returns on earned premiums have generally trended down since 2008. ALIRT says this trend accelerated in 2011, driven by catastrophe losses.

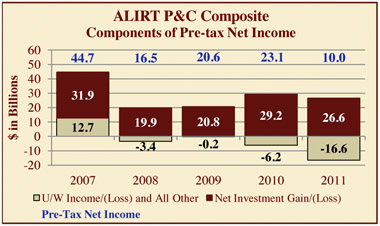

The ALIRT Composite has not generated an underwriting profit since 2007, ALIRT says, however despite low interest rates, investment gains continue to outweigh poor underwriting results.

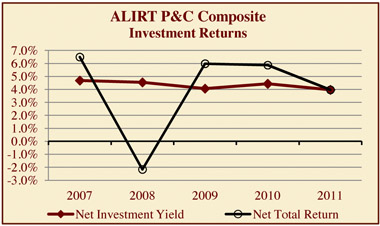

Investment yields continue to be dampened by low interest rates, ALIRT finds. In 2009 and 2010, net capital gains boosted returns significantly, but in 2011 net capital gains were break-even.

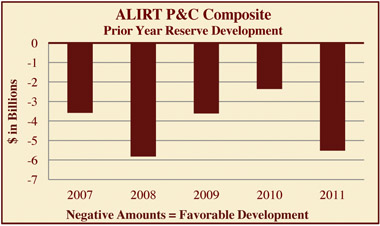

Favorable prior year reserve development was declining as the soft market dragged on, but reserve releases were again quite large for the ALIRT Composite in 2011.

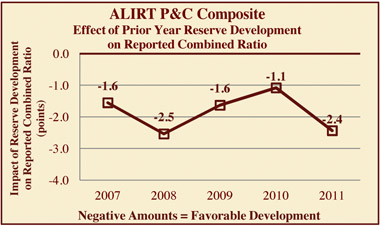

The reported combined ratio has been helped by favorable reserve development over the last several years. This was particularly noticeable in 2011 as reserve releases lowered the reported combined ratio for the ALIRT Composite by 2.4 points.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.