When evaluating the cause of agents' E&O claims, one of the current hot spots deals with the manner in which claims are handled at the agency level.

While many agencies have a staff dedicated solely to this function, in other agencies this function is handled by an account exec/customer-service representative as part of their duties. But either way, the bottom line is: This claims-handling task is resulting in a number of E&O claims. From my experience, at least 40 percent of agency E&O claims are caused by claims-handling within the agency.

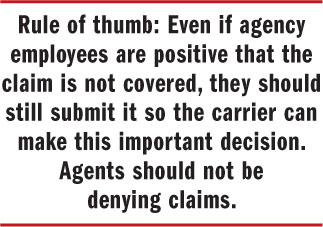

One common scenario, which probably occurs frequently within virtually every agency, involves a customer calling to advise your agency of a claim—but then after discussing it with you, deciding not to file the claim. This could be because the claim is not much more than the amount of the deductible, or that the customer will lose his loss-free discount, or because of the additional premiums he will have to pay due to a claims surcharge.

One common scenario, which probably occurs frequently within virtually every agency, involves a customer calling to advise your agency of a claim—but then after discussing it with you, deciding not to file the claim. This could be because the claim is not much more than the amount of the deductible, or that the customer will lose his loss-free discount, or because of the additional premiums he will have to pay due to a claims surcharge.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.