The last day of the latest Florida legislative session (March 9) saw the passage of a measure to help bring reform to the state's auto-insurance system.

The last day of the latest Florida legislative session (March 9) saw the passage of a measure to help bring reform to the state's auto-insurance system.

The insurance industry and others praised the approval of a bill to fix what the industry has called a significantly broken auto-insurance system plagued by abuse and fraud, which costs Sunshine State residents $1 billion annually.

The no-fault, personal-injury protection (PIP) reform bill easily made it through the state House—but only narrowly passed through the Senate, 22-17.

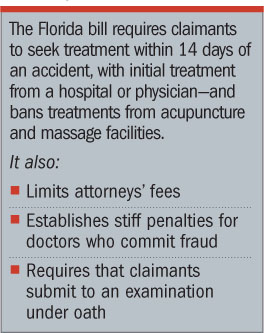

The bill requires claimants to seek treatment within 14 days of an accident, with initial treatment from a hospital or physician. The bill bans treatments from acupuncture and massage facilities.

The bill also limits attorneys' fees, establishes stiff penalties for doctors who commit fraud and requires that claimants submit to an examination under oath.

The final measure also establishes rate-reduction benchmarks to ensure insurers pass expected savings to consumers.

According to the National Association of Mutual Insurance Companies (NAMIC), the bill was close to death on several occasions.

“PIP reform was a brutal, hard-fought battle in the Florida House and Senate, right down to the final day of the session,” Liz Reynolds, NAMIC's state affairs manager, says in a statement. “While the final PIP legislation does not contain every measure needed to fight PIP fraud and abuse, it is still a win for companies writing auto business in Florida—and especially a victory for the policyholders they represent.”

All signs point to Gov. Rick Scott signing the bill.

Meanwhile, in other PIP news, to counter doctors conspiring to cheat New York's no-fault PIP system, a rigorous statewide initiative is under way to close medical offices billing for services that are either wholly unnecessary or were never rendered to auto-accident victims.

Under the new regulation, physicians engaging in unscrupulous billing practices to siphon funds from New York's PIP system will ostensibly turn themselves into pariahs, at least in the professional sense.

The new statute, which the Department of Financial Services (DFS) is issuing under the direction of Gov. Andrew M. Cuomo, implements a 2005 law that affords DFS the power to regulate doctor participation in the no-fault system. Doctors found to be in violation would be banned from the PIP system altogether and risk losing their certification.

“The state has no tolerance for medical providers or doctors ripping off the system,” Gov. Cuomo says in a statement.

DFS has already identified 135 medical providers whose billing practices have raised concerns regarding possible no-fault fraud through audits and information obtained from law enforcement and insurers.

As part of an ongoing investigation, letters are being sent to all 135 medical providers demanding a response and information. According to the department, failure to answer the letters may automatically lead to the medical provider being banned from the no-fault system.Florida, New York Move on Needed PIP Reform

|Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.