NU Online News Service, March 12, 1:29 p.m. EST

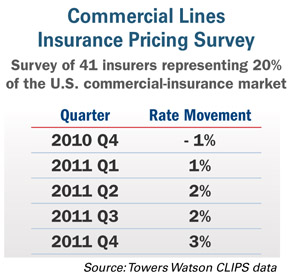

Commercial lines insurance rates rose 3 percent in the 2011 fourth quarter, according to a Towers Watson survey, providing further evidence that the years of soft-market momentum may be reversing course.

In a summary of the results of its CLIPS survey (Commercial Lines Insurance Pricing Survey), Towers Watson says survey results indicate a progressive rise in rates throughout 2011.

The quarterly survey, conducted since the 2003 second quarter, indicates insurance pricing has been in soft-market decline since the 2004 third quarter, with slight positive growth in the 2009 second quarter.

The quarterly survey, conducted since the 2003 second quarter, indicates insurance pricing has been in soft-market decline since the 2004 third quarter, with slight positive growth in the 2009 second quarter.

Last year was the first year pricing has shown continued upward movement for more than a quarter since 2004, according to Towers Watson figures.

“While modest, aggregate increases in prices continued, and more importantly, these increases accelerated in each quarter of 2011,” says Thomas Hettinger, property and casualty sales and practice leader for the Americas at Towers Watson in a statement. “We are now at a point where we can call the pricing turn in the market.”

Towers Watson says specialty lines as a whole were flat and directors and officers liability pricing showed signs of stabilizing.

Commercial property and workers' comp grew in the 4 to 6 percent range, the spokesman says, and workers' comp had the largest increase by line during the fourth quarter.

Towers Watson went on to say that historical loss-cost information reported by participating carriers points to 3 percent deterioration in loss ratios in accident year 2011 compared to 2010.

“This indication is more favorable than the estimated level of 5 percent deterioration for the accident year 2010 loss ratio over 2009, as earned price increases are beginning to offset portions of reported claim-cost inflation,” the firm says.

The survey was conducted between mid-January and mid-February. A total of 41 insurers representing approximately 20 percent of the insurance market participated in this quarter's survey.

Full survey results are only available to participants, a spokesman says.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.