NU Online News Service, Feb. 13, 3:40 p.m. EST

For a while, Insurance Information Institute President Robert Hartwig has been telling anyone who’ll listen that we will not experience a double-dip recession—that global crises would not derail recovery in the economy.

New evidence supports his theory, but insurers may be slow on the uptake, he says.

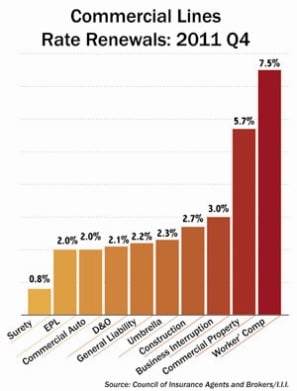

Insurance rate renewals are up. Commercial rates went up just under 1 percent in the 2011 third quarter and 2.8 percent in the fourth quarter after 30 straight quarters of price declines.

But more than that, Hartwig says there is opportunity for insurers beyond waiting for rate increases.

The insurance industry “needs to not just ride the rising tide in,” he says. “There is a new trajectory of growth in the American economy.”

The insurance industry “needs to not just ride the rising tide in,” he says. “There is a new trajectory of growth in the American economy.”

Uncharacteristic industries not typically involved in economic rescue are leading the way, paving a road to opportunity for insurers who recognize it, says Hartwig, who recently gave a presentation at the National Association of Mutual Insurance Companies’ Claims Conference in Savannah, Ga.

Energy, natural resources, agriculture, health care, and transportation and infrastructure are at the beginning stages as the country’s newest growth engines, Hartwig says.

“And many insurers would find that they are underexposed to these sectors,” Hartwig says.

The largest growth area may be due to the age demographics of the country. Because of insufficient returns, insurers may have shunned from writing workers’ compensation in the health care industry, for example, but continuing to do so is “removing yourself from the largest growth area in the next 10-20 years,” Hartwig predicts.

With new technology and discoveries, the energy sector is undergoing a renaissance which calls for new distribution networks, large facilities and transportation.

The insurance industry has been wearing “green-colored eyeshades,” focusing on the needs of “green” energy, but Hartwig says investments in traditional oil and gas will dwarf those made in alternative energy.

A renewed commitment to energy will become a “potent driver of exposure growth,” as the price of energy will be pushed down to levels not seen in decades, Hartwig says.

This will subsequently lead to cheaper manufacturing and transportation costs in the U.S. Hartwig excitedly speaks of the rebirth of manufacturing—steel, automobiles, petro-chemicals and plastics—in the U.S. instead of abroad. With manufacturing returning from overseas or starting anew here, workers’ compensation, environmental and liability risks will need insuring.

Hartwig sees an unemployment rate of below 8 percent by the third quarter of this year. When more people return to work, they’ll purchase more vehicles and reverse a trend of older cars on the road, he adds.

“Insurers should be looking at realignment with these industries,” Hartwig says. “This is not a traditional hard market, but there are ongoing opportunities.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.