Yogi Berra once quipped, “Nostalgia ain't what it used to be.” Risk managers can relate. Even though Berra was not referring to relationships with an insurance broker, he very well could have been. On top of their many other roles, risk managers should expect to have to justify the current brokerage relationship to upper management, more so than ever before.

Yogi Berra once quipped, “Nostalgia ain't what it used to be.” Risk managers can relate. Even though Berra was not referring to relationships with an insurance broker, he very well could have been. On top of their many other roles, risk managers should expect to have to justify the current brokerage relationship to upper management, more so than ever before.

When risk managers “manage” the relationship with outside insurance brokers, they should prepare for headwinds from upper management. Bland assurances of value-added relationships may not placate the top brass. C-level executives and boards of directors feel heightened pressure to demonstrate transparency in all financial transactions. The Sarbanes-Oxley Act and other corporate governance initiatives require that directors and officers ensure that the organization gets full value from every business relationship. This includes the insurance brokerage arrangement. Risk managers must assure upper management that the current broker is not involved in contingent commission arrangements or bid-rigging.

Building the Case for Broker vs. Broker

The risk manager's case for choosing one broker versus another (or multiple “others”) must be well-thought out, rehearsed, and distilled to a concise essence. If the risk manager wants to change brokers, this is also a challenge that merits meticulous preparation. The risk manager may have 10 minutes (if that) before the board to advocate for a certain broker or to change partners.

In preparing the case to keep or switch insurance brokers, risk managers must make a convincing presentation. Expect to answer questions from higher-ups, such as:

- “Have you put the brokerage arrangement out for competitive bidding?”

- “You say we are getting the best deal. Exactly how do you know that?”

- “Should we split our insurance programs among multiple brokers to 'keep them honest'?”

- “Even if you are happy with the current broker, should we not consider other brokers on regular basis, just to keep the incumbent on his or her toes?”

These are tough questions for sure. Many risk managers may not welcome them. They may seem intrusive and awkward. Nevertheless, even those risk managers with long-standing ties to specific brokers may be challenged to justify and rationalize that relationship on financial and quantitative grounds. Generalities carry little weight. Historical inertia or the incumbency of multiple years is simply not a compelling factor to higher-ups.

These are tough questions for sure. Many risk managers may not welcome them. They may seem intrusive and awkward. Nevertheless, even those risk managers with long-standing ties to specific brokers may be challenged to justify and rationalize that relationship on financial and quantitative grounds. Generalities carry little weight. Historical inertia or the incumbency of multiple years is simply not a compelling factor to higher-ups.

Questoins to Anticipate

One reason is that organizational layers above the risk manager are typically populated with quantitative and financial types. There is nothing wrong with this. Given their training and background, though, they will have questions that risk managers will be expected to adequately address. Lines of questioning might resemble the following:

- “How much money has the broker saved us?”

- “What specific coverage enhancements has the broker obtained that we could not have leveraged anyway?”

- “What exactly differentiates the incumbent broker from the competition?”

- “What services do we get from the current broker that we could not obtain elsewhere?”

Those “soft and fuzzy” feelings do not cut it. The fact that the broker is a friend, has had a long-standing 15-year relationship with the company, throws nice holiday parties, or treats you to dinner at the finest steakhouse at the RIMS Conference is irrelevant to upper management.

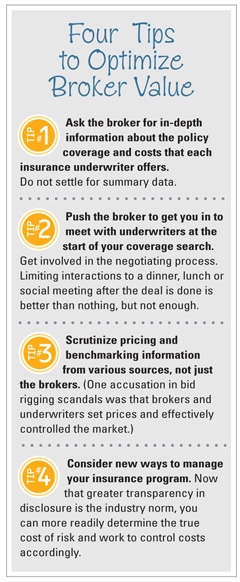

The moral here is that risk managers must do their homework. They must have data, specifics, examples, and vignettes to either justify the existing broker relationship or make a cogent case for change. In this “age of transparency,” expect director and officer (D&O) scrutiny into areas of the operation and brokerage relationship into which they have never ventured before.

Partnering with Brokers

One upshot is building good relationships with the brokerage community. Burn no bridges when (and if) you must part ways. However, let brokers know the pressure you are under to justify and rationalize the relationship. Work with them to make a compelling case to the CFO, CEO, and the board of directors. Brokers can be vital behind-the-scenes allies in building a case. In this realm, you two have common interests in staying the course.

Relationships with incumbent brokers may seem to be working well. They may be comfortable. Though we have all heard the adage, “If it ain't broke, don't fix it,” the executive suite and board will not view historical inertia as a reason to perpetuate even long-standing brokerage relationships. With so many functions and jobs being outsourced and put out for competitive bidding, it would be naïve to think that the broker relationship is immune to scrutiny.

Politics may also enter the equation. Outside company directors may nominate for consideration their own insurance broker. The CEO may have corporate peers and counterparts who advocate for other intermediaries. Risk managers should not dismiss lightly any suggestions to explore such options. The risk manager should investigate such leads and conduct a modicum of due diligence. It shows open-mindedness to upper management, demonstrating that its recommendations receive due weight and consideration. In some cases, it may actually unearth better avenues for service and cost savings to the company.

One factor possibly making this less awkward is the fact that most brokers are—or should be—aware of the new business climate. In a sense, all brokers may be paying for the sins of the few. They must be aware of the scrutiny under which virtually all brokers are placed. This should engender not only sympathy with the risk manager's plight but also motivate the broker to collaborate with the risk manager to add value to the relationship and make it as bulletproof as possible.

So why should risk managers care about “selling” the broker relationship? Reasons abound. For one, if the risk manager is comfortable with the current broker, then making a cogent case facilitates continuity in the risk management program. It enhances upper management's ability to promote transparency within the organization while reinforcing top management's confidence that the risk manager is “on top of things” and getting true value from the broker partnership.

Additionally, it keeps risk managers on their toes, in a constructive way, in ensuring that key business relationships perpetuate on the basis of value added, not on the basis of social ties and chemistry. Finally, the discipline of regularly revisiting the relationship can unearth genuine opportunities to have incumbent brokers “raise their game” or to trigger a justified change to explore new options.

Berra was right in saying that “nostalgia ain't what it used to be.” Nevertheless, by successfully selling the brokerage relationship to upper management, risk managers heighten the odds that they—and their brokers—may have long-term relationships that spawn many happy memories.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.