NU Online News Service, Jan. 20, 11:42 a.m. EST

Rate increases for 2012 could head as high as 10 percent if a handful of negative pressures continue to affect insurers' earnings, a financial analyst suggests.

Meyer Shields, an analyst with Stifel Nicolaus, says the combination of global natural and man-made catastrophe losses along with loss-cost inflation from 2011 catastrophes, insurers' merger and acquisition activity, RMS Version 11 catastrophe model revision, and worsening core underwriting results is “setting the stage for significant mid-2012 rate increases” of around 10 percent on commercial lines business.

After a record first half of the year in catastrophe losses, the fourth quarter of 2 011 provided some loss relief, sayd Shields in a preview of insurance industry fourth-quarter earnings.

011 provided some loss relief, sayd Shields in a preview of insurance industry fourth-quarter earnings.

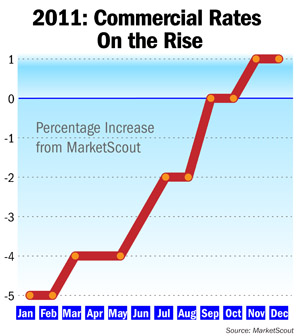

In the commercial lines area, rates began to increase or were at least flat, the report says, with workers' compensation increasing by 3 percent, according to figures cited from MarketScout, an online insurance market exchange.

But the recent comercial rate improvement “shouldn't benefit carriers' underwriting margins yet, as loss cost inflation is still outpacing rate increases,” Shields says.

P&C pricing on catastrophe property could also get a boost from increased reinsurance rates as a result of more than $100 billion in insured global losses in 2011. Also contributing to reinsurance demand is the RMS Version 11 hurricane model revisions, which raises loss expectations.

However, brokers will see some organic growth benefit as rates improve and the economy improves.

Auto and homeowners will continue to see rate increases, Shields adds. He blames loss-cost inflations worsening as driving increases, higher auto repair from accidents, medical care costs increase and pressure from recent years' storm losses.

Adding to the pressure on rates, Shields says, is unprofitable underwriting results reflected in an industry combined ratio above 100 since 2008 and poor returns on investments.

Reserve releases are expected to slow further in 2012 “allowing poor accident year results to determine reported [earnings per share] and ultimately boost rates,” Shields writes.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.