At the beginning of 2011, Aviation insurance brokers fully expected to see a move toward a hardening market over the course of the year. Instead, the line produced a year of pricing decreases—and no one is anticipating any big jumps in 2012.

At the beginning of 2011, Aviation insurance brokers fully expected to see a move toward a hardening market over the course of the year. Instead, the line produced a year of pricing decreases—and no one is anticipating any big jumps in 2012.

“Unless there is a significant event in terms of reduced capacity or a major disaster, we do not see any drivers of rate increases in 2012,” says Peter Schmitz, CEO of Aon Risk Solutions Global Aviation Specialty. “The main driver of rates is an individual airline’s book of business.”

Recent renewal premiums ranged from flat to down 10 percent, says Schmitz.

Jeff Bauer, president of NationAir Aviation Insurance, shares the view that it’s unlikely rates will take off in 2012. “If an account is particularly desirable [to an insurer], then maybe we’ll even see a decrease,” he says.

Three factors conspired to keep Aviation prices from gaining altitude last year. One was losses: 2011 turned out to be one of the safest years in recent aviation history, with no significant loss of life.

In early December Aon released a report saying that there were a total of 175 lives lost covered under Standard-Liability policies; the long-term average is 582 fatalities. It was the first time since 1995 that by Dec. 1 the number of fatalities was under 300.

“2011 was great in terms of safety,” says Steve Doyle, business development and sales director for Aerospace Willis Group.

“If the loss trend continues, it will be hard for underwriters to substantiate any rate increases even though they are selling [insurance] below costs,” says Nigel Weyman, chairman of Jardine Lloyd Thompson Aerospace.

“If there is an absence of a major loss during the first half of the year, the pressure will be on underwriters to give away more [premium] growth,” Weyman adds.

The second factor keeping the market from hardening is ample capacity. Insurers are attracted by the industry’s positive loss-trend results and by their desire to diversify their portfolios with solid-performing risks.

Schmitz says there is nothing to indicate that capacity will decrease. In fact, some underwriters may increase their capacity.

Weyman notes that the only scenario he sees for a change in the market is if there is economic turmoil or a substantial natural catastrophe that forces carriers to withdraw their available capacity to redeploy it elsewhere. “We’re not seeing any significant capacity issues in the next 12 months,” he says.

A third reason for premium decreases is the consolidation of the airline market. The reduction in the number of carriers is also reducing the premium base for carriers to draw from. That means, for especially desirable risks, intense competition to get that business into an underwriting portfolio.

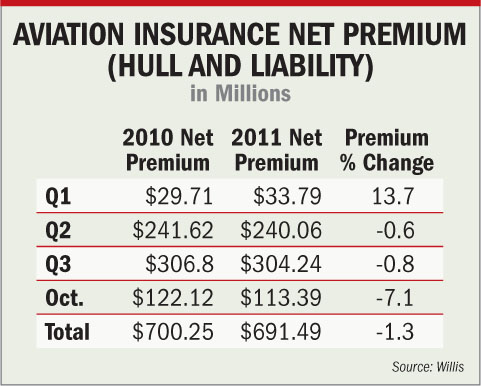

Although the total figures for 2011 are still preliminary, Doyle says fleet numbers for the year were up 6 percent while passenger numbers rose by 8 percent. However, despite these increases, overall premium volume fell by 2 percent—a sure sign of a soft market.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.