Two steps forward, one step back: For every couple of events that augured a definitive swing to a hard market this year—a major catastrophe here, increasing combined ratios there—some other factor contributed to helping keep prices soft, whether it was fear over the eurozone debt crisis or underwriters willing to heavily discount new business.

Two steps forward, one step back: For every couple of events that augured a definitive swing to a hard market this year—a major catastrophe here, increasing combined ratios there—some other factor contributed to helping keep prices soft, whether it was fear over the eurozone debt crisis or underwriters willing to heavily discount new business.

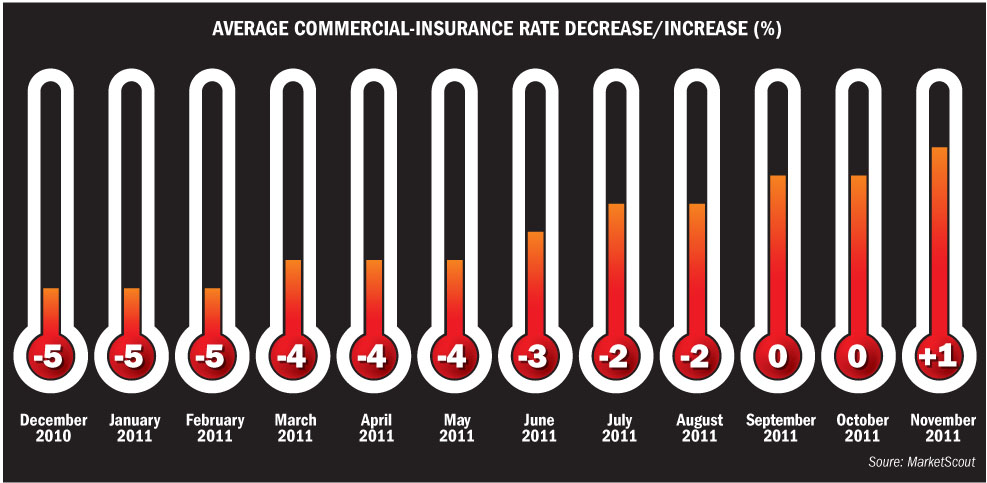

But while the pace of change has been staggered and unsteady—and is still by no means universal across all lines—there is little doubt that the market has undergone a significant transition in 2011.

In January, market conditions could be summed up as mostly soft, with pockets of flattening prices. By September/October, the consensus was the overall market had finally hit bottom. And by November, the pricing picture could be described as upward bound, if barely so, for the first time in eons—or at least since 2005.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.