If one could use only a single word to sum up 2011, “catastrophes” best captures what this year was all about.

If one could use only a single word to sum up 2011, “catastrophes” best captures what this year was all about.

January started on a soggy note with large pockets of Australia under water, as floods caused insured losses of up to $3 billion. Just the next month, the Southern Hemisphere suffered again, as New Zealand saw a 6.3 earthquake that toppled buildings in Christchurch and led to claims north of $10 billion (part of a nightmarish, 12-month stretch where Kiwis experienced multiple quakes, including one in September of 2010 and another one in June of this year).

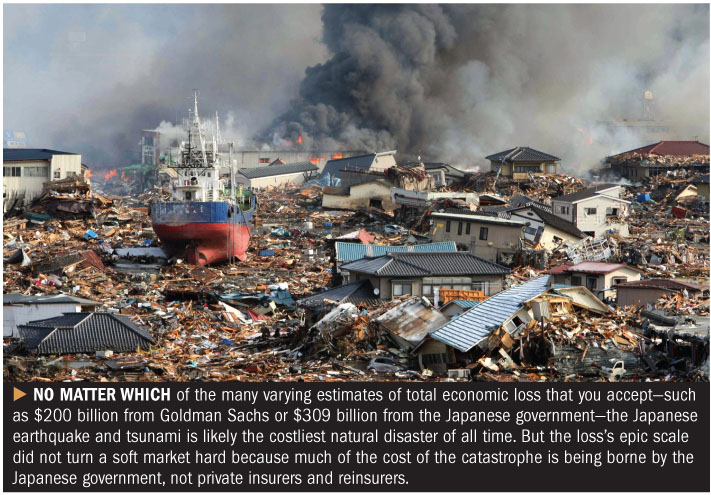

Then, for a few unforgettable weeks in the late winter and spring—from the massive Japanese earthquake and devastating tsunami that followed through the spate of tornadoes that ravaged the U.S. in April and May—it seemed like a major disaster struck every other day.

Then, for a few unforgettable weeks in the late winter and spring—from the massive Japanese earthquake and devastating tsunami that followed through the spate of tornadoes that ravaged the U.S. in April and May—it seemed like a major disaster struck every other day.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to asset-and-logo-licensing@alm.com. For more information visit Asset & Logo Licensing.