NU Online News Service, Dec. 13, 11:14 a.m. EST

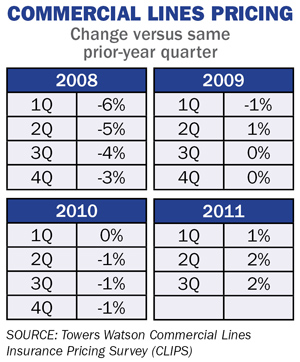

For the second straight quarter, all standard commercial lines showed an increase in pricing, but it isn't enough to keep up with loss costs.

According to Towers Watson's Commercial Lines Insurance Pricing Survey (CLIPS), commercial insurance prices rose 2 percent during the 2011 third quarter—especially for mid-market and large accounts—but loss costs have increased 4 percent to date this year, compared to 2010.

Bruce Fell, managing director of Towers Watsons' property and casualty practice in the Americas, says "we will not be in a market where insurance company results can improve, and we start to en ter a real hard market" until rate increases exceed loss-cost inflation.

ter a real hard market" until rate increases exceed loss-cost inflation.

Results are backed up by a recent survey Towers Watson did of chief financial officers. Close to two-thirds of surveyed CFOs say property market prices are at the bottom of the cycle and turning upward.

The results were mixed in specialty lines, according to Towers Watson. For instance directors' and officers' liability, for the seventh straight quarter, saw price reductions.

Workers' compensation and commercial property led the way with price insurances. Price hikes in workers' compensation are driven by actuarially unsound pricing for some time. Commercial price increases have been influenced by global catastrophes this year.

According to CLIPS, predictive modeling is playing a large role in pricing and risk selection. Companies that use modeling achieve greater results than those that do not, the survey found. More than 50 pecent of premium volume corresponds to the use of predicting modeling for pricing and more than 30 percent can be attributed to insurers use of the tool for risk selection, says Towers Watson.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.