NU Online News Service, Dec. 9, 1:58 p.m. EST

A day after a Chartis executive questioned whether “micro cycles” might replace traditional market turns, analyst firm ALIRT Insurance Research weighed in on the question of whether the traditional cycle might be a thing of the past.

In its “Nine Month 2011 P&C Industry Review,” ALIRT quotes Travelers CEO Jay Fishman, who said in a recent conference call, “We're much more skeptical that the amplitude of the cyclicality that many of us grew up with in this business remains. For a whole host of substantive systemic reasons, we just don't think it exists in the same way anymore.”

Yesterday, speaking at the 22nd Annual Executive Conference in New York, produced by The National Underwriter Co. and Summit Business Media, Chartis Chief Executive Officer of Global-Commercial Business, John Q. Doyle offered similar views. He said that as tools insurers use to look at risks get more advanced and accurate, companies will be able to deploy capital shrewdly, which could produce  “shorter, flatter cycles” with “less up and down” fluctuations.

“shorter, flatter cycles” with “less up and down” fluctuations.

ALIRT says in its report that the industry has seen a more expansive specialty market, modern data/data-mining capabilities and a more sophisticated/less-forgiving reinsurance market, all of which would seem to support the theory of flattening cycles. But the firm adds, “While all of this is true, one thing that has not changed is human nature. So long as we, by nature, look to satisfy short-term desires at the expense of longer-term goals, a pronounced market cycle—at least in the commercial-line market—will likely persist.”

As for the current cycle, ALIRT says the property and casualty underwriting cycle appears to be at, or near, an inflection point, but might not be at the point of a pronounced hard market yet.

ALIRT notes the difference in market observations between company executives and brokers. In third-quarter analyst calls, ALIRT says, management at large publicly traded companies declared that the pricing environment is improving, and that the market is hardening.

Brokers, though, have issued studies saying that rates will continue to be flat to slightly lower. “One broker opined that rates are 'firming but not hardening,'” ALIRT says. “While this may at first appear an equivocation, it actually captures the current environment quite well: broad rate decreases are coming to an end, but conditions remain competitive, especially for new business, and therefore no pronounced hard market is in sight.”

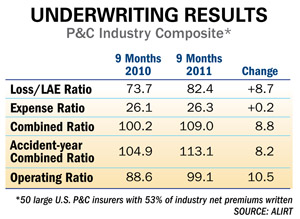

In its review, ALIRT analyzed 50 large U.S. P&C insurers representing about 53 percent of total industry net-written premiums through the first nine months of 2011. ALIRT says underwriting results have “weakened appreciably” so far this year, going by both accident-year and reported combined ratios (accident-year combined ratio excludes the impact of prior-year reserve development).

ALIRT says the reported combined ratio for the first nine months of 2011 was 109.4, about seven points weaker than the full-year 2010 combined ratio, due mostly to catastrophe losses. The accident-year combined ratio for the first nine months of 2011 was 112.4, almost seven points weaker than 2010.

However, ALIRT notes that when examining the reported and accident-year combined ratios over the last several years, the two are still running on a parallel track. “For a true hard market to take hold,” ALIRT says, “we will likely have to see a crossing over of these two ratios and a pronounced divergence between them.” This would mean a shift from prior-year reserve redundancies to reserve deficiencies, which ALIRT says has still not yet occurred.

ALIRT also measured the carriers against its proprietary scoring method, which measures the financial strength of individual carriers against composite benchmarks.

David Paul, a principal for the firm in Windsor, Conn., explained to NU earlier this year that ALIRT scores—derived every quarter from an analysis of operating and investment ratios as well as other financial-strength measures—range from 0-100, with higher scores assigned to stronger insurers. The 10-year median industry score is right in the middle—at 50.

A composite score below 50 may act as a leading indicator of a turn, Paul says, explaining that the score can be viewed as a “pain gauge” that can highlight the point when insurers “begin to get fearful about balance-sheet deterioration.”

The P&C commercial-lines score has been trending downward since early 2007, but had been above 50 since the middle of 2005, until the 2011 first quarter. Since then, it has dipped further below 50 throughout the year.

ALIRT says in its report, “If such composite-score deterioration is sustained…this could precipitate harder-market conditions.

ALIRT's analysis also found:

- ALIRT composite surplus declined 4.2 percent in the first nine months of 2011 due to underwriting losses, shareholder dividends of $8 billion and net capital losses of $4.6 billion.

- Net investment yield fell 87 basis points to 3.57 percent in the 2011 first half, compared to 4.44 percent for the full-year 2010. Net investment income was over 12 percent lower than the prior-year period, due to low interest rates and a slight drop in invested assets, ALIRT says.

- Direct and net premiums rose by 2.2 percent and 3.6 percent respectively in the first nine months of the year.

ALIRT concludes, “In the end, we know that whether it happens quickly or gradually, a shift to harder pricing is coming. Underwriting results in some of the key commercial lines—such as workers' compensation—are so poor that some corrective action must be taken.”

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.