Plenty of room for improvement exists among insurers looking to maximize their customers’ experience and gain new business, according to a new survey.

Plenty of room for improvement exists among insurers looking to maximize their customers’ experience and gain new business, according to a new survey.

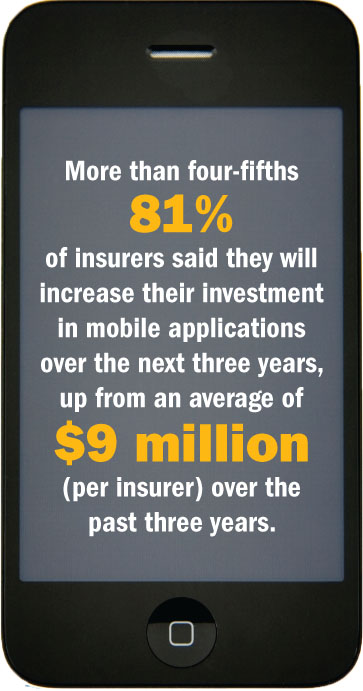

Insurers that individually invested $30 million, on average, in analytics and mobile capabilities over the past three years still believe they should be doing more to win over customers, according to the survey by Accenture.

Accenture gathered data from 119 major insurance companies around the world—equally divided between life and property-and-casualty carriers—in 24 countries. The survey was conducted by market-research firm Kadence Ltd. from February through May of this year.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.