NU Online News Service, Nov. 8, 9:36 a.m. EST

NU Online News Service, Nov. 8, 9:36 a.m. EST

The freak October snowstorm that dumped more than 2 feet of snow in some locations is expected to be a major capital or credit event for the property and casualty insurance industry, says credit rating service Moody's.

The Oct. 29 storm knocked out power to close to two million homes and businesses at its height over a six-state region.

The storm is expected to result in economic damage in excess of $1 billion.

Moody's says the storm is credit negative for P&C insurers in the U.S. and is expected to adversely affect earnings “during a year of unprecedented catastrophe losses.”

Tree damage is expected to be substantial as the storm piled snow on leaf-covered trees. The weight of the snow snapped many limbs and huge branches, which produced damage to homes and cars from downed trees and limbs.

Debris removal and auto accidents add to the tally of damages.

There may also be “time-element” claims such as reimbursement for additional living expenses—such as hotel stays—for those displaced from their homes during the power outage, Moody's says.

While no damage estimates have yet to be released, losses are expected to be substantial and will add more pressure to 2011 earnings that have already suffered from a number of weather related events loss events this year, the rating agency adds.

By Wednesday last week, NU Online News Service reported a number of insurers were receiving a large number of claims. In addition, the Insurance Services Office's Verisk Analytic's Property Claim Services declared the event a catastrophe—meaning insured losses will exceed $25 million in Connecticut, Massachusetts, New Hampshire, New Jersey, New York, Pennsylvania. States of emergency were declared in each state.

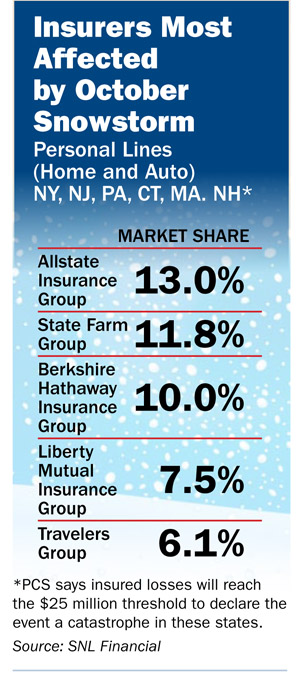

Insurers with a large presence in the Northeast are most exposed to claims resulting from the storm, Moody's says.

According to SNL Financial, the top five personal-lines insurers (home and auto) in the most-affected states in 2010 were Allstate Insurance Group, State Farm Group, Berkshire Hathaway Insurance Group, Liberty Mutual Insurance Group and Travelers Group.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.