NU Online News Service, Nov. 1, 1:14 p.m. EDT

NU Online News Service, Nov. 1, 1:14 p.m. EDT

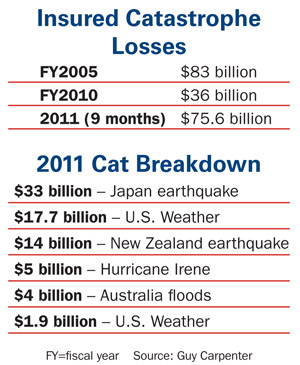

Through the first nine months of this year, insured catastrophe losses are close to rivaling the worst insured catastrophe year of 2005—and the bulk of those losses can be traced back to events in Asia, according to a report from Guy Carpenter.

The reinsurance broker, a subsidiary of Marsh & McLennan Cos., says that for the first nine months of this year, global catastrophe losses reached $76 billion, 67 percent of which is tied to catastrophes in Japan, New Zealand and Australia.

The global results of this year have already surpassed what was recorded in 2010 and 2009 combined, says Guy Carpenter.

The report says demand for catastrophe reinsurance is growing in the Asia Pacific region “and all indications point to further growth for the future.”

The broker estimates that a quarter of the total catastrophe excess of loss limit purchased around the world is for coverage in the Asia Pacific region.

Guy Carpenter goes on to say that while the share of premium for catastrophe excess of loss is just under 15 percent, it represents a doubling of global premiums over 2007, “evidencing considerable growth of the region in just four years.”

The insurance markets are dominated by mature markets in Japan and Australia. Insurance penetration is high and the associated purchase of catastrophe reinsurance from the international market is significant.

The other Asia Pacific powerhouses—China, India and parts of South East Asia—“have shown the most impressive growth rates globally.” The markets are competitive because supply exceeds demand. Reinsurers and insurers see the growth possibilities in these markets and international reinsurers are “keen to achieve a market presence in these territories.”

However, due to recent loss activity and the reality that the region is home to extensive seismic activity, Guy Carpenter asks if the international players may “re-think their business strategies.”

The report notes that among some pressures the reinsurance industry may feel toward doing business in the region is inadequate rates compounded by low interest rates on investments. They must also deal with increased risk-capital requirements that will be required under Solvency II and associated compliance costs. Growing inflation remains another concern along with the purchasing power in the future.

Despite these concerns, Guy Carpenter says reinsurers' capital remains “more than sufficient” to meet demand and “competition makes the general market direction difficult to foresee” at this time.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.