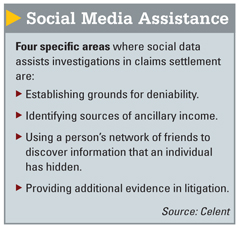

It's clear that social media usage has risen in all age groups, and the large swaths of information posted by individuals reflect preferences, lifestyles, habits, and, in some cases, neuroses. Insurers can use this mounting social data to create a real-time risk profile while shaping more effective claims and underwriting operations, Celent explains in its new report, "Using Social Data in Claims and Underwriting."

It's clear that social media usage has risen in all age groups, and the large swaths of information posted by individuals reflect preferences, lifestyles, habits, and, in some cases, neuroses. Insurers can use this mounting social data to create a real-time risk profile while shaping more effective claims and underwriting operations, Celent explains in its new report, "Using Social Data in Claims and Underwriting."

Although there has been much buzz about the potential full impact of harnessing social data, until fairly recently few strategic solutions had surfaced. But Celent is leading the discussion on broader applicability, presenting a five-step model to operationalize social data. The model outlines the major decisions that should be addressed in implementation: what data should be used, what technical strategy should be adopted, how to acquire the data, how to analyze it, and how to integrate social data with existing operational systems. Standard Inputs into Risk Evaluation

Integrating these data inputs into insurers' existing process and automation environment will drive more optimal results in both claims and underwriting, assert Celent Analyst Craig Beattie and Senior Analyst Mike Fitzgerald, authors of the report. They stress that one of the keys to successful implementation will be tempering enthusiasm with the reality that social data is still in its formative stages.

"This [social data] implementation will not be without challenges," Beattie says. "Key techniques must be developed or enhanced, including reliable authentication methods, improved data extraction tools, and more advanced analysis tools."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.