We have all had a hunch that 2011 would be one of the worst years on record for catastrophic losses. Now, the numbers are in to prove it. Swiss Re reported in September that natural catastrophes and man-made disasters across the globe are projected to cost the insurance industry around $70 billion in the first half of 2011. That figure makes 2011 already the second-costliest year in history for catastrophic losses, and we're not done yet with Q3 and Q4 losses yet to be calculated. Hopefully, we are done with major disasters for this year, but when all of the losses are tallied for 2011 we could surpass the 2005 record when catastrophe claims reached $120 billion.

We have all had a hunch that 2011 would be one of the worst years on record for catastrophic losses. Now, the numbers are in to prove it. Swiss Re reported in September that natural catastrophes and man-made disasters across the globe are projected to cost the insurance industry around $70 billion in the first half of 2011. That figure makes 2011 already the second-costliest year in history for catastrophic losses, and we're not done yet with Q3 and Q4 losses yet to be calculated. Hopefully, we are done with major disasters for this year, but when all of the losses are tallied for 2011 we could surpass the 2005 record when catastrophe claims reached $120 billion.

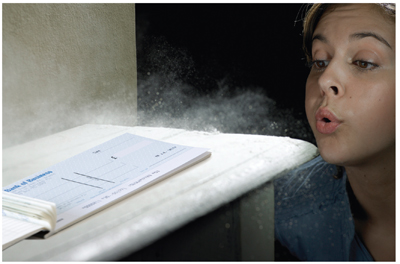

With the tornadoes, hurricanes, and wildfires having battered many regions of the U.S. this year, we have all witnessed the aftermath of these disasters as communities and residents struggle to get their lives back to normal. Awaiting settlement payments is one of the most common frustrations insureds experience. The good news is that there are new payment solutions available today that can accelerate the process, improve customer satisfaction, and reduce carrier costs. Specifically, innovations for replacing paper settlement checks with pre-paid debit cards are gaining traction among leading carriers and dramatically improving performance across the board.

Carriers Go "Paperless"Electronic payment innovations have ushered in a new "paperless" trend, as consumers increasingly prefer to carry less cash in their wallets because of the convenience of debit cards. Financial institutions and the retail industry have led the charge and consumers have saved time and money with rewards and loyalty programs tracked through their debit cards. Consumers today can conduct all of their banking online, pay for nearly all of their purchases with debit cards and opt into receiving electronic statements online instead of cluttering up their wallets and filing cabinets. Federal and state agencies such as the U.S. Postal Service, the Social Security Administration, the Internal Revenue Service and many state tax agencies have embraced electronic payment technologies. An increasing number of insurance carriers are also catching on to the trend.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.