Some of the leading insurance industry analysts have been inquiring of insurance carriers about what the future holds for mobile technology—both for business users and consumers.

Insurance is considered a late adapter of mobile technology—a reputation the industry has justly earned for about every technological shift of the last 20 years.

But patience doesn't necessarily mean inaction. For insurers, mobile technology today is much like the Internet was in the 1990s.

As you quite likely noticed, the industry eventually caught up and has reached the point where, as Forrester's Ellen Carney points out, “It's a good thing now to be part of IT and insurance. You're not a cost to the business anymore, you are the business.”

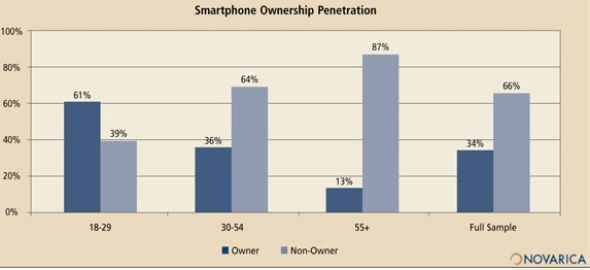

Someday mobile might be the business as well. Young people take their computers with them wherever they go in the guise of a telephone. Smartphone use is soaring among people under the age of 29 and that means the coming years will see even more movement toward mobile.

The use of tablets is also expected to increase, particularly when the cost of devices and service begins to lower and users find they are more than just cool toys, but valuable tools for business—and life. (Remember when computers were supposed to be for business use and not for consumers?)

What follows on the next few pages are some statistical studies conducted by SMA, Novarica, and Celent that examine several key issues concerning the future of mobile technology.

Mobile in the Enterprise

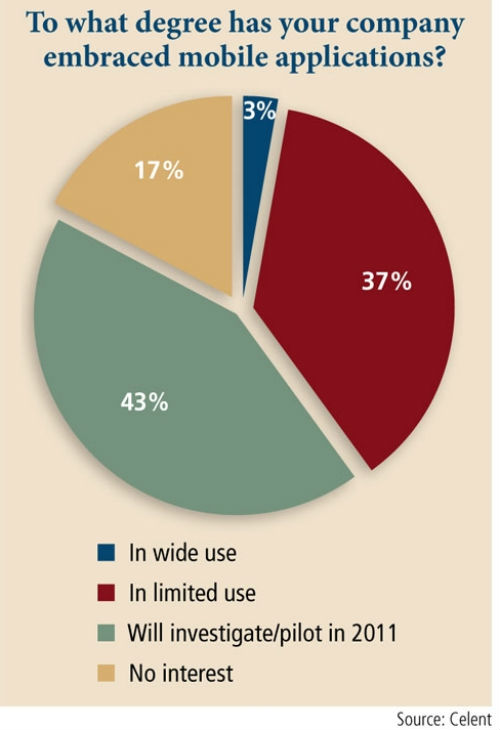

Earlier this year, Celent asked insurance IT leaders to list what level of adoption they have achieved within the enterprise. The number of carriers where mobile is being widely used is a paltry three percent, but only 17 percent reported not having any interest in mobile technology at all, which leaves a rather large percentage in the middle with their toes in the water.

Consumer Smartphone Adoption

Over 60 percent of people between the ages of 18 and 29 own smartphones today, according to Novarica. That is the only age breakdown where such a phenomenon exists, but in total, one-third of those interviewed use smartphones rather than cellphones. Needless to say, Novarica expects smartphone ownership to increase in all age groups over the next three years.

Mobile Spending for P&C Insurers

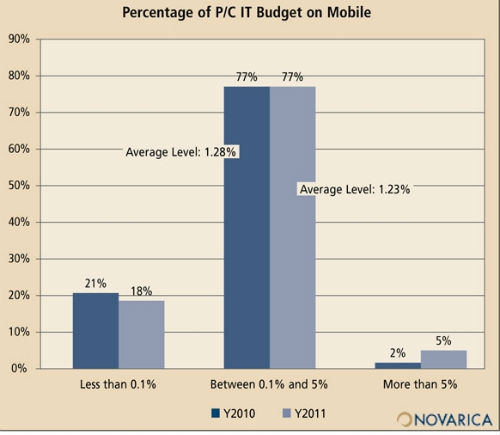

It may come as a surprise to some, but Novarica is estimating that property & casualty insurers will spend slightly less of their IT budget on mobile technology this year than they spent in 2010. The average level of spending is estimated at 1.23 percent of the IT budget in 2011, compared to 1.28 percent last year.

Mobile for Consumer Use

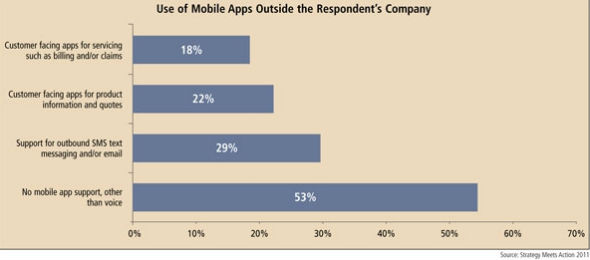

SMA asked insurance carriers how mobile apps are being used for consumers. Over half the companies surveyed said they do not support mobile apps for anything other than voice, but approximately 20 percent offer apps for servicing policyholders and for providing product information and quotes.

Mobile for Internal Users

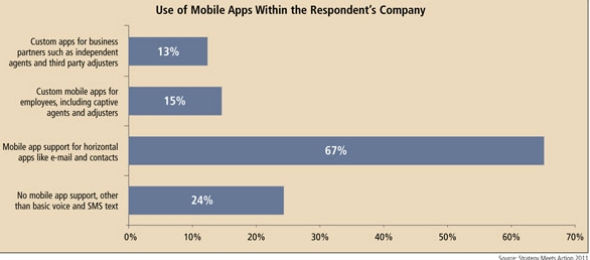

SMA also asked insurers how mobile apps are being used internally for business users. Some two-thirds of respondents offer email and contacts for mobile users, but the use of custom apps remains low: 15 percent for captive agents and adjusters and 13 percent for independent agents and independent adjusters.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.