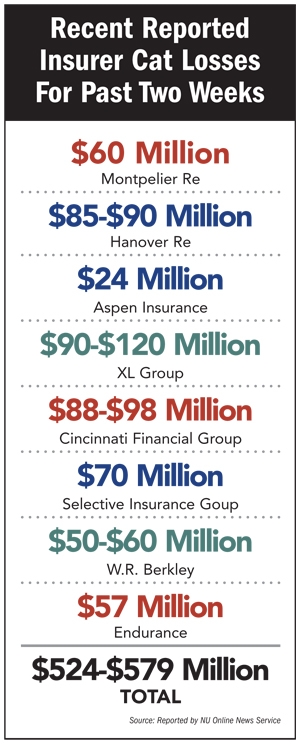

Hamilton, Bermuda-based insurer Montpelier Re Holdings Ltd. estimates its third-quarter catastrophe losses will stand at around $60 million before taxes, and along with Aspen Insurance losses, reported cat insurance losses in the third quarter are well over $500 million in the past two weeks.

The estimate is comprised of $30 million from U.S. events including Hurricane Irene and the Texas wildfires, $20 million from U.S. regional aggregate covers, and $10 million from the July Danish floods, the company says.

In addition, the company estimates it will incur $10 million of net losses from the June 2011 New Zealand earthquake.

All of these amounts are net of retrocessional recoveries and reinstatement premiums.

Montpelier adds that in view of the uncertainties associated with preliminary estimates, its actual losses may differ, perhaps significantly, from these amounts.

Hamilton, Bermuda-based Aspen Insurance Holdings Ltd., also announced a total of $24 million in catastrophe losses in the quarter.

The company estimates losses from Hurricane Irene of $10 million and $14 million for other natural-catastrophe events which occurred in the third quarter of 2011, including weather-related events in the United States, Scandinavia and Asia.

In addition, the company increased its second-quarter 2011 U.S. severe-weather-related losses by $17 million, from $65 million at June 30, 2011 to $82 million. Aspen says the “increase is consistent with the increase in estimated market losses from these events to $20 billion from $15 billion.

Aspen says its losses are net of applicable reinsurance, reinstatement premiums and tax.

Within the past two weeks, NU Online News Service has reported seven insurers' pre-tax catastrophe losses totaling between $500 million and $555 million.

The insures are:

• XL Group

Catastrophes have taken a bite out of insurers' earnings at least for the first half of this year, according to at least two recent reports.

The Insurance Services Office, based in Jersey City, N.J., in conjunction with the Des Plaines, Ill.-based Property Casualty Insurers Association of America and the New York-based Insurance Information Institute report that private U.S. property and casualty insurers' net income fell to $4.8 billion for the first half of 2011 compared to $16.8 billion for the same period a year ago—a drop of 71 percent.

Driving the decline were net losses on underwriting, growing $19 billion to more than $24 billion for the first half of the year.

Insurance rating service A.M. Best says U.S. P&C industry underwriting for the first half of 2011 fell 67 percent to $6.9 billion, and its statutory combined ratio deteriorated more than 9 points to nearly 110 through the first half of 2011.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.