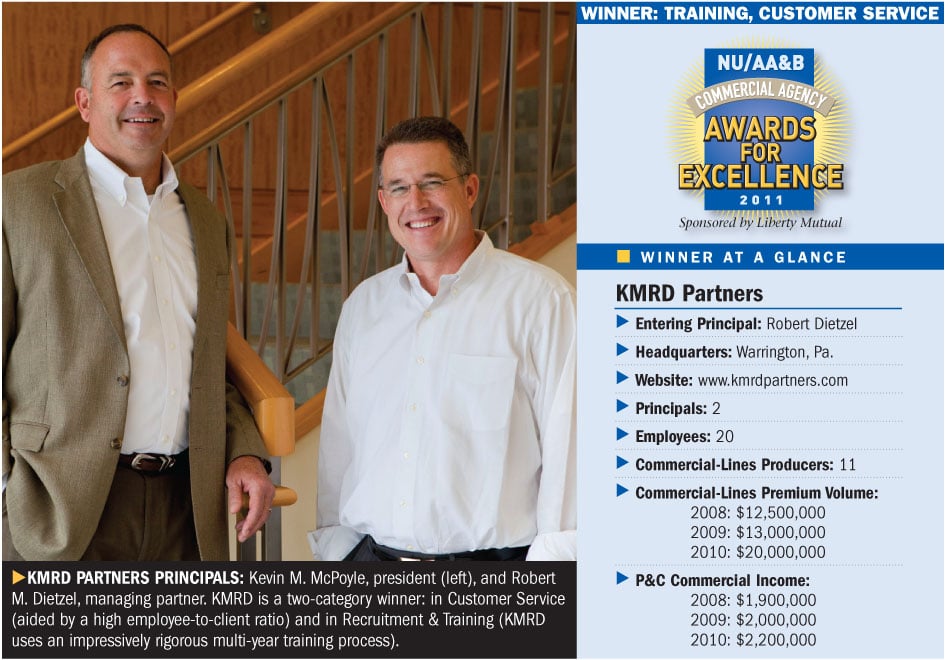

Having one of the highest employee-to-client ratios in the insurance industry—one servicer for every two accounts—means, as you might expect, that KMRD Partners, winner of the 2011 NU/AA&B Commercial Agency Awards for Excellence in Customer Service, can provide exceptional attention to every piece of business.

Having one of the highest employee-to-client ratios in the insurance industry—one servicer for every two accounts—means, as you might expect, that KMRD Partners, winner of the 2011 NU/AA&B Commercial Agency Awards for Excellence in Customer Service, can provide exceptional attention to every piece of business.

And indeed, the firm, founded in 2005 by Kevin McPoyle and Robert Dietzel after they spent 12 years at a top agency in Philadelphia, prides itself on its client-focused culture—which includes, for example, reviewing with a magnifying glass every term, condition and exclusion when a policy is first issued by a carrier.

"Most agencies are built on a volume of transactions," Dietzel says. "They simply do not have the resources to read every policy they sell in detail."

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.