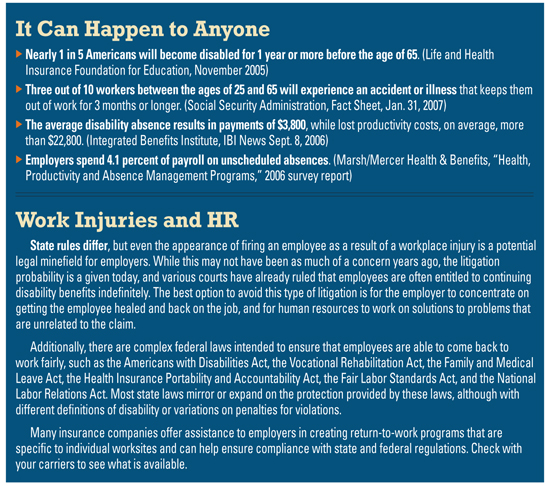

No matter how safe an employer tries to make the worksite, accidents can still happen. The National Safety Council (NSC) reports that a disabling injury occurs every 1.3 seconds in the U.S. (more than 63,000 every day), and the Social Security Administration predicts that 3 out of 10 workers entering the workforce today will acquire some type of disability before they retire.

Getting injured employees back to work quickly—and providing positive communication and assistance during the rehabilitation process—has always been an important aspect of successful workers' compensation programs. Research consistently shows that injured employees whose companies offer return-to-work programs recover faster, are more satisfied with their care, return to their full-duty jobs sooner, and are released from medical care earlier than if no return-to-work programs are in place.

In addition to positively impacting employee morale and productivity, effective return-to-work programs can result in lower premium rates—an important consideration given the rising medical and benefit costs associated with workers' compensation. The NSC reports that a single work-related disabling injury costs an employer an average of $48,000. The National Council on Compensation Insurance (NCCI) estimates, based on 2009 data, that medical costs comprise 58 percent of the overall costs of a lost-time claim, and that number keeps climbing. (In fact, the number has risen 11 percent in the past 20 years.) High medical and pharmaceutical costs are driving this hike, but economic conditions—including workers worried about returning to jobs with an uncertain future—are supporting these increases.

Although employers may be reluctant to pay injured employees their full salary for modified or alternate work (especially because this type of work may carry a perception of decreased productivity), the alternative is to use those same benefits to continue to pay injured employees almost their full salaries but receive zero productivity in return. Worse, disability itself can be dangerous and self-perpetuating. According to the American College of Occupational and Environmental Medicine (ACOEM), the odds of an injured employee ever returning to work drop by 50 percent by just the twelfth week of disability. Legal Matters

There is another important benefit for employers who offer medically appropriate modified or alternate work while an injured employee is recovering. If the employee declines this job offer, then the employer is in a much stronger position to prevail if the claim is litigated. It is tough to argue that an employee who rejected a reasonable offer to return to work should expect to receive long-term workers' compensation benefits. Employers who routinely make good faith job offers have more favorable results in court. Conversely, the odds of having a judge remove an employee from workers' compensation benefits drops significantly without a return-to-work job offer.

There is another important benefit for employers who offer medically appropriate modified or alternate work while an injured employee is recovering. If the employee declines this job offer, then the employer is in a much stronger position to prevail if the claim is litigated. It is tough to argue that an employee who rejected a reasonable offer to return to work should expect to receive long-term workers' compensation benefits. Employers who routinely make good faith job offers have more favorable results in court. Conversely, the odds of having a judge remove an employee from workers' compensation benefits drops significantly without a return-to-work job offer.

Avoiding litigation altogether is the optimum position, and here again return-to-work programs can help. The Workers Compensation Research Institute released a study in 2010 that found that workers are more likely to seek legal help when they feel threatened. Return-to-work programs offer assurance to employees that their jobs are safe, help combat fraud, and provide timely, positive communication. According to the California Workers' Compensation Institute, calling injured employees within a week after an accident to talk about their value to the company reduces the chance of a lawsuit by 50 percent.

A Different Workforce

Returning injured employees to the workforce as quickly as medically possible has always been the intended goal of workers' compensation insurance. While that objective has not changed, the workforce has.

According to the U.S. Small Business Administration, small businesses today represent 99.7 percent of all employer firms, and employ just over half of all private sector employees. This includes 40 percent of high-tech workers such as scientists, engineers and computer programmers. Some of these employees are so highly engaged at work that they may tend to work through an injury and not report it, or delay reporting it.

Unfortunately, putting off seeking medical care can lead to an eventual claim that can take longer for the employee to heal, require more employer support, and cost the company far more than it would if the employee had sought help early. If employees know in advance they will have a job even if they are injured, then they are more likely to follow proper reporting and medical protocol. A strong return-to-work program can make a difference by providing employees with appropriate communication and education. Today's businesses also employ increasing numbers of individuals age 65 or older, a trend that seems likely to increase. According to the Department of Labor, a baby boomer turns 60 every 7 seconds. This generation is extending its working years dramatically because of both better health and the large scale collapse of retirement savings. They have experience, and they contribute greatly. However, the Bureau of Labor Statistics estimates that it takes an older worker two to three times longer than a younger worker to recover from the same injury. Employers who are prepared with workable, temporary job plans can dramatically cut these claim costs.

Anticipated NCCI Revisions

In Florida, workers' compensation rates are calculated using a formula involving manual rates specific to job duties and classification, payroll, and an experience modification factor (mod). NCCI uses a complex formula to calculate the mod for eligible employers. The idea is to spread the cost of loss through members of a group likely to experience similar losses. For fairness, NCCI uses each company's actual payroll and loss data over a 3-year period. Companies who do not qualify for a mod, or who have had average loss experience, break even at a 1.00 mod and pay the average rate.

Companies with higher loss histories receive higher mods and thus pay more in premium. And since the cost of a specific accident is statistically less predictable than the frequency, NCCI has long given greater weight (and penalty) to accident frequency than to accident severity through a split-point rating approach for costs. However, a change to this process is on the horizon.

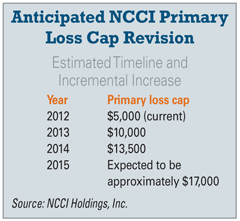

Historically, NCCI divides losses into primary and excess portions, with a longtime split point with a $5,000 cap. (The primary costs are weighted at 100 percent in the mod formula for lost-time claims; any amount over that is allocated to excess and weighted at a lower percentage.) A company with several small losses creates a higher mod than a company with a single, larger loss even if the total loss dollars are the same.

Historically, NCCI divides losses into primary and excess portions, with a longtime split point with a $5,000 cap. (The primary costs are weighted at 100 percent in the mod formula for lost-time claims; any amount over that is allocated to excess and weighted at a lower percentage.) A company with several small losses creates a higher mod than a company with a single, larger loss even if the total loss dollars are the same.

The NCCI has proposed changing that primary loss cap beginning in 2013, the first such change in 25 years. The anticipated change—if approved—is expected to more than triple the current cap by 2015.

This gradual increase over 3 years is intended to compensate for the increased claims amounts over the past years. While the optimum goal for employers will still be zero accidents and a mod of 1.00 or lower, the change is expected to bring an immediate and significant mind-shift about the impact of losses. By 2015, when the phase-in is complete, approximately $17,000 in claim costs will be factored into mods at 100 percent. This amount will be indexed for inflation for years after 2015. The result is premiums for companies with higher-than-average losses will increase, while companies with better-than-average losses will be reduced.

Agents can help their clients get on track by emphasizing the value of loss control return-to-work programs. If employers improve their loss experience, then they can improve their mods, which will reduce their premiums in the long run. For employers who are not mod-eligible, improving loss experience can still save money by lowering claims costs. And given today's soft market, better loss experience can also help with insurability.

The Time Is Now

The short story is that today more than ever it is worth the effort to find light-duty positions for injured workers while they recover. Having a return-to-work program gives employers a tool to manage their workers' compensation costs; sometimes it is the only thing they can control in this ever-changing market. The small upfront costs are minimal when compared to the potential landslide of long-term claim-related expenses.

In the end, risk drives costs; severity follows frequency; and return to work drives savings. When discussing workers' compensation coverage with clients, return to work is the savvy agent's talking point. A solid return-to-work program is much like insurance: It is easy for clients to think they do not need it—until it is too late.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.