In the view of industry analysts, Chartis is moving in the right direction: giving its asbestos liabilities to a Berkshire Hathaway company; mostly sitting out of the workers' compensation game; reducing writings in the volatile excess-casualty market; and cutting back on catastrophe-exposed property lines.

The new leadership and a massive reorganization plan (see interview with Chartis CEO Peter Hancock on page 12) also are generally seen in a positive light.

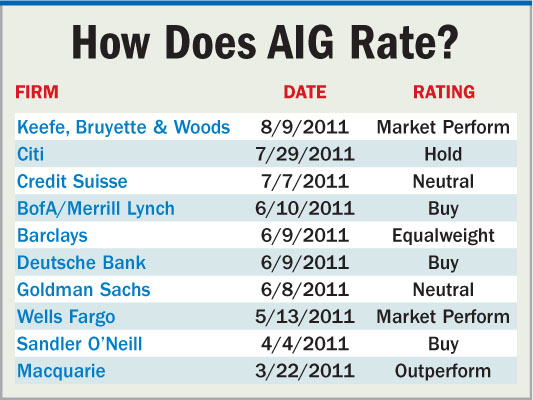

But “there's still a lot of fixing to do,” says Cliff Gallant, an analyst with Keefe, Bruyette & Woods. “Chartis has not been as profitable as its competitors. There's work to do to close that gap. It has been a while since they've turned an underwriting profit.”

But “there's still a lot of fixing to do,” says Cliff Gallant, an analyst with Keefe, Bruyette & Woods. “Chartis has not been as profitable as its competitors. There's work to do to close that gap. It has been a while since they've turned an underwriting profit.”

Chartis' 2011 second-quarter combined ratio was 104.0 compared to 102.0 in the second quarter of 2010.

Standard & Poor's predicts Chartis will post a combined ratio of 103-104 in 2011 (97-98, excluding catastrophes and including potential reserve development).

STUNG, BUT STILL ON TOP

The companies that comprise Chartis have lost business since the near collapse of parent American International Group Inc. (AIG) in 2008 and, according to an A.M. Best Co. credit report, “Though diminished, the lingering impact of the reputational damage suffered by its parent company has been a drag on the group's business in recent years.”

Parent AIG may no longer have any outstanding debt with the U.S. government, but the feds still own 77 percent of the company, and taxpayers are not yet whole.

But despite the massive challenges of an unprecedented crisis, Chartis has found a way to maintain market-leadership positions in multiple lines, especially commercial and specialty (see charts on page 19).

Bruce Ballentine, an analyst with Moody's Investor Service, cites Chartis' global diversification, broad product mix and expertise in writing complex risks as positives.

“Not a lot of compa nies can offer such breadth,” Ballentine says. “The foundation has proven to be strong.”

nies can offer such breadth,” Ballentine says. “The foundation has proven to be strong.”

When Peter Hancock—originally hired to guide AIG through its recapitalization plan and eventual independence from federal assistance—was named CEO of Chartis in March, the group also outlined a reorganization of its management team and a new business structure.

Robert Benmosche, CEO of AIG, told NU at the time that the combination of changes at Chartis would “generate top-line growth, providing clarity to sales” by streamlining operations.

However, “fixing a property and casualty company is not easy,” Gallant says. “It'll take several years to close the gap.”

RESERVE RESERVATIONS

Chartis took an underwriting loss of $5.2 billion for the last quarter of 2010 primarily because of reserve charges. AIG took a charge of more than $4 billion in the fourth quarter to bolster Chartis' loss reserves.

About 80 percent of the charge will be put toward adverse development from accident years 2005 and older for four classes of business: asbestos, excess casualty, excess workers' compensation and primary workers' compensation.

Early this year Chartis paid Berkshire's National Indemnity Insurance Co. $1.65 billion to take the bulk of its asbestos liability.

“One headache has been removed, but their recent [reserves] history is not very good,” Gallant says.

A.M. Best says Chartis has needed to strengthen prior-year loss reserves in three of the last five years.

And other rating agencies list the company's history of adverse-loss development as a cause for concern.

Fitch Ratings says AIG's credit and financial-strength rating could be negatively affected going forward if Chartis sees reserve releases “that are inconsistent with industry trends.”

Second-quarter results this year reflected no significant prior-year loss-reserve development, according to Chartis.

LONG-TERM PROJECT

Ballentine says the reorganization plan has provided Chartis observers with a “new starting point to watch performance over multiple reporting periods.”

But “it is going to take time to show the benefits of this shift in thinking,” Ballentine adds.

Standard & Poor's agrees. In a report, the rating agency says, “Although management remains highly focused and continues to make marked progress, we believe it will take a few years for the positive changes to permeate throughout the organization.”

Hancock seemed to recognize the plan would take time to bear fruit, when he told NU at the time of his appointment as CEO, “You'll wake up one or two years from now and know we have more effectively leveraged our global scale.”

S&P also offers an interesting take on Chartis' new operational style.

“Making these changes throughout such a large, globally diverse organization might distract the operations from other businesses,” S&P says. “This could put AIG at a disadvantage relative to its peers.”

While Chartis has faced past allegations from analysts that the company was guilty of poor underwriting, some see evidence of a greater emphasis now on properly pricing risk.

“With new management and oversight of the actuarial function, expectations of ultimate losses for current accident years may increase, which may result in lower profitability in the near term, but which should lead to enhanced stability and adequacy of reserves over time,” A.M. Best says in its credit report of Chartis.

Adds Ballentine: Chartis' “emphasis on risk is significantly greater than before the crisis.”

In sum, one industry observer says it's helpful to think of Chartis in terms of a professional sports team: They had a few disastrous seasons, but the franchise has survived and has made some significant off-season moves and management changes that look good on paper. Now it's time to execute on the field.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.