NU Online News Service, Aug. 1, 11:40 a.m. EDT

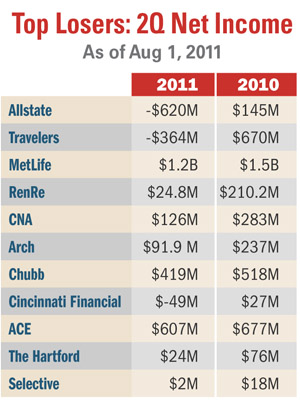

Allstate Corp. says more than $2.3 billion in catastrophe losses drove a $620 million second-quarter loss.

Losses from more than 30 events, which include 25 wind and hailstorms, five tornadoes and several wildfires, accounted for 36.2 points to Allstate’s second-quarter combined ratio of 123.3.

Premium written in the homeowners’ segment increased 2.6 percent compared to the same period a year ago. Rate increases averaging 6 percent were approved in 18 states during the quarter.

The auto segment saw a 0.9 percent decrease in second-quarter premiums written.

Without catastrophes, Allstate says gains within its underlying business improved. The underlying combined ratio was 87.5 (excluding catastrophe losses and prior-year reserve re-estimates), compared to 88.1 last year during the same time.

Addressing reports of a decline morale among agents, President and Chief Executive Officer Thomas J. Wilson says during a conference call that last week he met with more than a dozen senior vice presidents who work the agency field as well as 1,000 of the company's top agent performers and they are "highly supportive of our strategy," and are focused on what he termed the Personal Touch loyalist segment.

Allstate continues steps to increase the size of its agencies and align its compensation system with individual performance. Allstate says its variable compensation to agents will be increased from 10 percent to 25 percent commission, based on improvements in the agency’s business, which will mean more cross-selling and building the scale of the firm. However, compensation on the sale of policies will be dropped from 10 percent to 8 percent on new and renewal business.

Allstate continues steps to increase the size of its agencies and align its compensation system with individual performance. Allstate says its variable compensation to agents will be increased from 10 percent to 25 percent commission, based on improvements in the agency’s business, which will mean more cross-selling and building the scale of the firm. However, compensation on the sale of policies will be dropped from 10 percent to 8 percent on new and renewal business.

The company has loaned money to agency owners to help mergers along, Wilson says.

Wilson admits this is a “hard thing to do,” particularly as the insurer works to fix its homeowners’ business—getting smaller in some areas and raising prices—in order to restore profitability.

Nevertheless, Wilson says, “We’re on our way to do this together.” The company and agency force are align, and are “locked arm-in-arm to go forward,” he continues.

Wilson says many agents are excited about the acquisition of Esurance, on track to close later this year.

“This is about doing what the customer wants,” Wilson says. “Everybody gets it.”

The National Association of Professional Allstate Agents Inc. (NAPAA) says it is asking members to vote on a proposal for the association to affiliate with the Office and Professional Employees International Union (OPEIU) as a guild in order to defend agents’ interest, which NAPAA says are being taken advantage of by Allstate.

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2024 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.