In 2010, the U.S. Congress passed the Nonadmitted and Reinsurance Reform Act (NRRA) as part of the Dodd-Frank Wall Street Reform legislation. To modernize the U.S. regulatory structure, the legislation allows only the home state of the insured to collect premium tax payments for nonadmitted insurance absent an agreement.

Dodd-Frank is very clear—it encourages the states to "enter into a compact or otherwise a procedure to allocate" these taxes among the states. The lack of a comprehensive agreement could prove very detrimental to states like Florida that could lose nearly $15 to $20 million in annual tax revenues. The result is that states are now confronted with two very important questions: 1) whether to join a tax-sharing agreement, and 2) if so, which agreement to join.

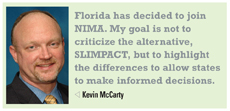

A year after Dodd-Frank has taken effect, two competing agreements have emerged. A coalition of states developed the Nonadmitted Multistate Agreement (NIMA), while surplus lines brokers and agents, along with the National Conference of Insurance Legislators (NCOIL), are in favor of an alternative agreement called SLIMPACT. Florida has decided to join NIMA.

A year after Dodd-Frank has taken effect, two competing agreements have emerged. A coalition of states developed the Nonadmitted Multistate Agreement (NIMA), while surplus lines brokers and agents, along with the National Conference of Insurance Legislators (NCOIL), are in favor of an alternative agreement called SLIMPACT. Florida has decided to join NIMA.

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.