During the first half of 2011, the P&C industry saw an unprecedented number of severe natural catastrophes in both the U.S. and abroad.

During the first half of 2011, the P&C industry saw an unprecedented number of severe natural catastrophes in both the U.S. and abroad.

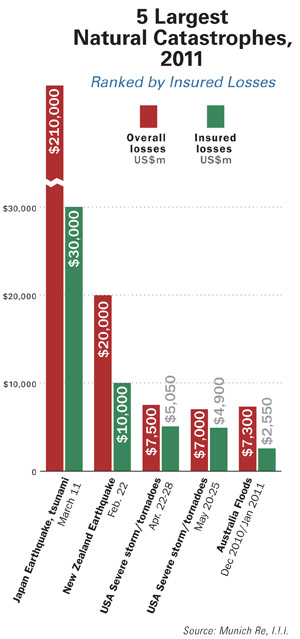

The accumulation of a total of 100 events—taking into account the deadly thunderstorms and deluge of tornadoes—produced an excess of $18 billion (and climbing) insured losses in the U.S. alone. The global distribution of natural loss events, including the 9.0-magnitude earthquake in Japan, along with the resultant tsunami, the earthquake and flooding in New Zealand, and the tornadoes and flooding in the U.S., has already made 2011 the costliest year for natural disasters on record.

A total of 355 events transpired during the first six months of the year and the likelihood of more severe storms is very high. Although there has only been one named storm since the beginning of the Atlantic hurricane season on June 1, CSU scientists predict a “75 percent more active Atlantic hurricane season than usual.”

Recommended For You

Want to continue reading?

Become a Free PropertyCasualty360 Digital Reader

Your access to unlimited PropertyCasualty360 content isn’t changing.

Once you are an ALM digital member, you’ll receive:

- Breaking insurance news and analysis, on-site and via our newsletters and custom alerts

- Weekly Insurance Speak podcast featuring exclusive interviews with industry leaders

- Educational webcasts, white papers, and ebooks from industry thought leaders

- Critical converage of the employee benefits and financial advisory markets on our other ALM sites, BenefitsPRO and ThinkAdvisor

Already have an account? Sign In Now

© 2025 ALM Global, LLC, All Rights Reserved. Request academic re-use from www.copyright.com. All other uses, submit a request to [email protected]. For more information visit Asset & Logo Licensing.